How to Deposit and Trade Crypto at Zoomex

How to Deposit to Zoomex

How to Buy Crypto with Credit/Debit Card on Zoomex

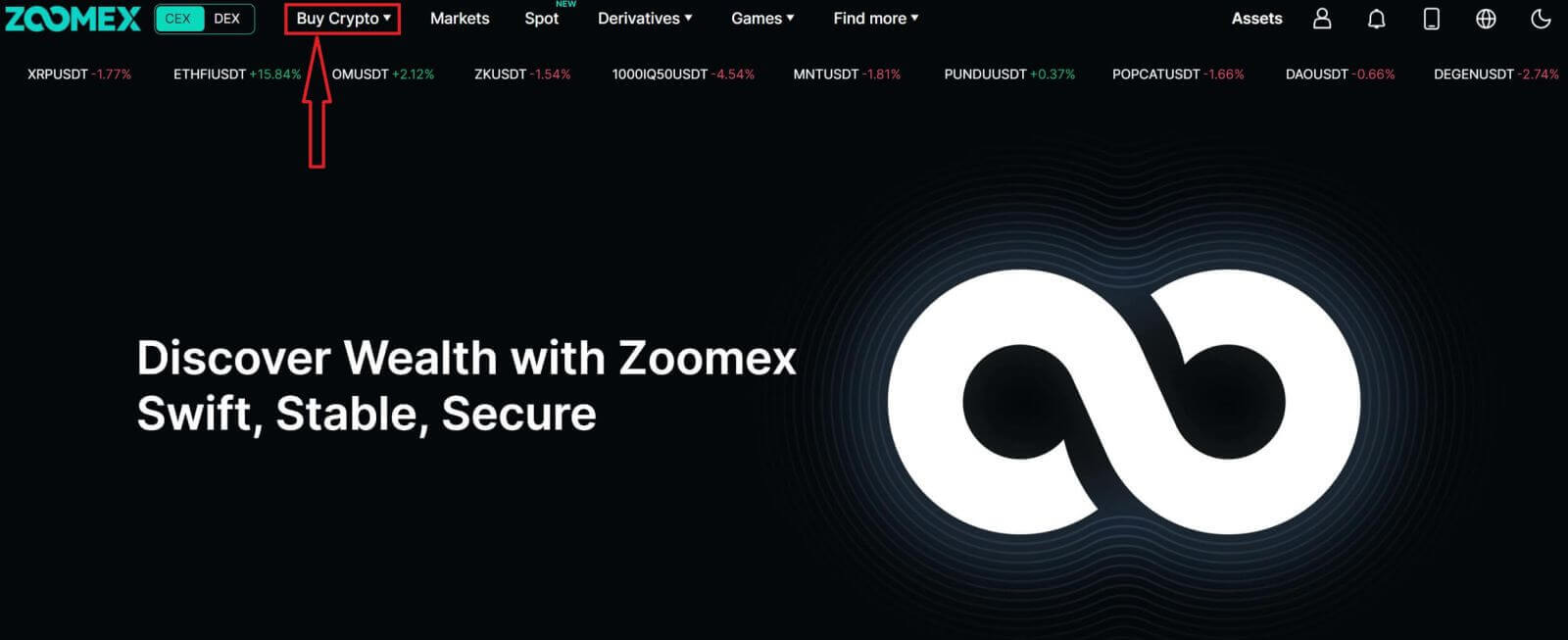

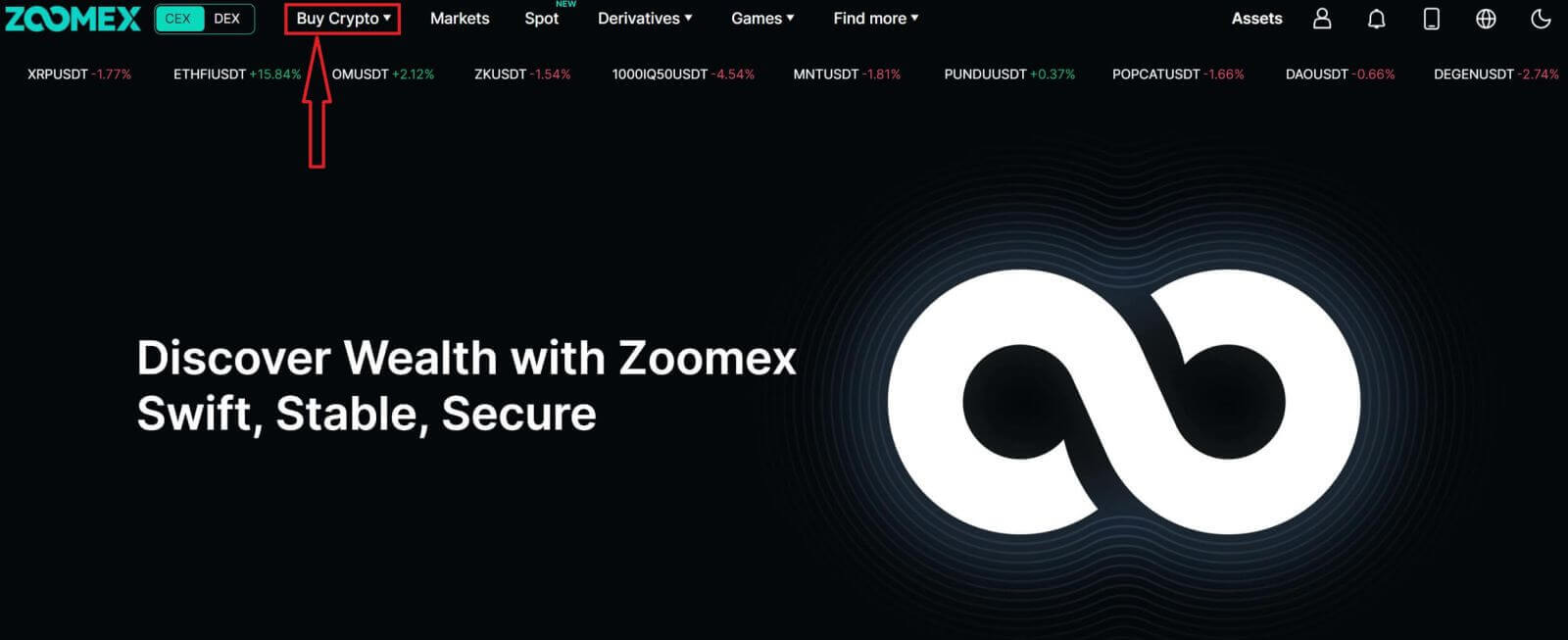

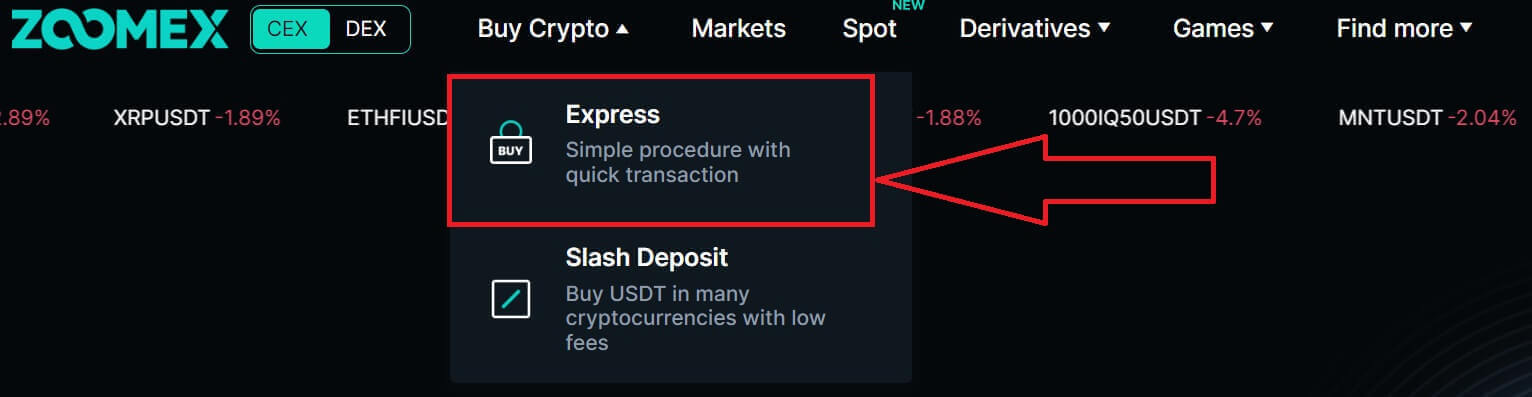

1. Go to the Zoomex website and click on [Buy Crypto].

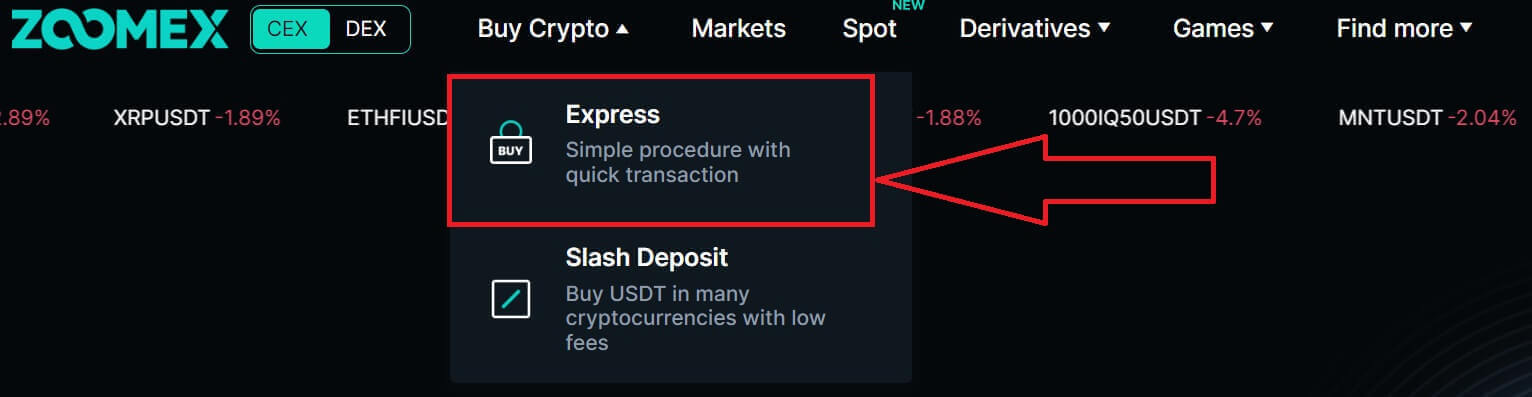

2. Select [Express] to continue.

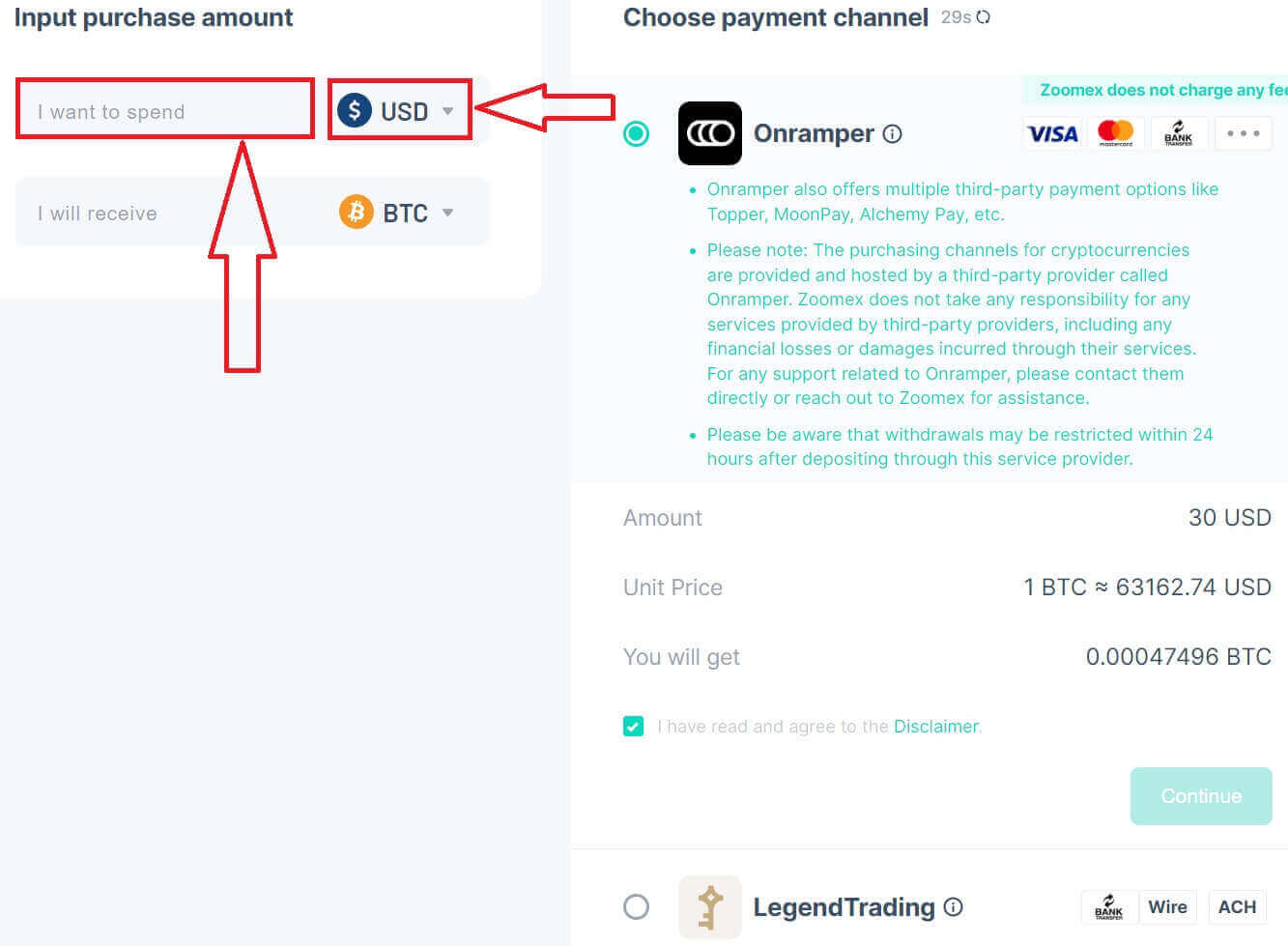

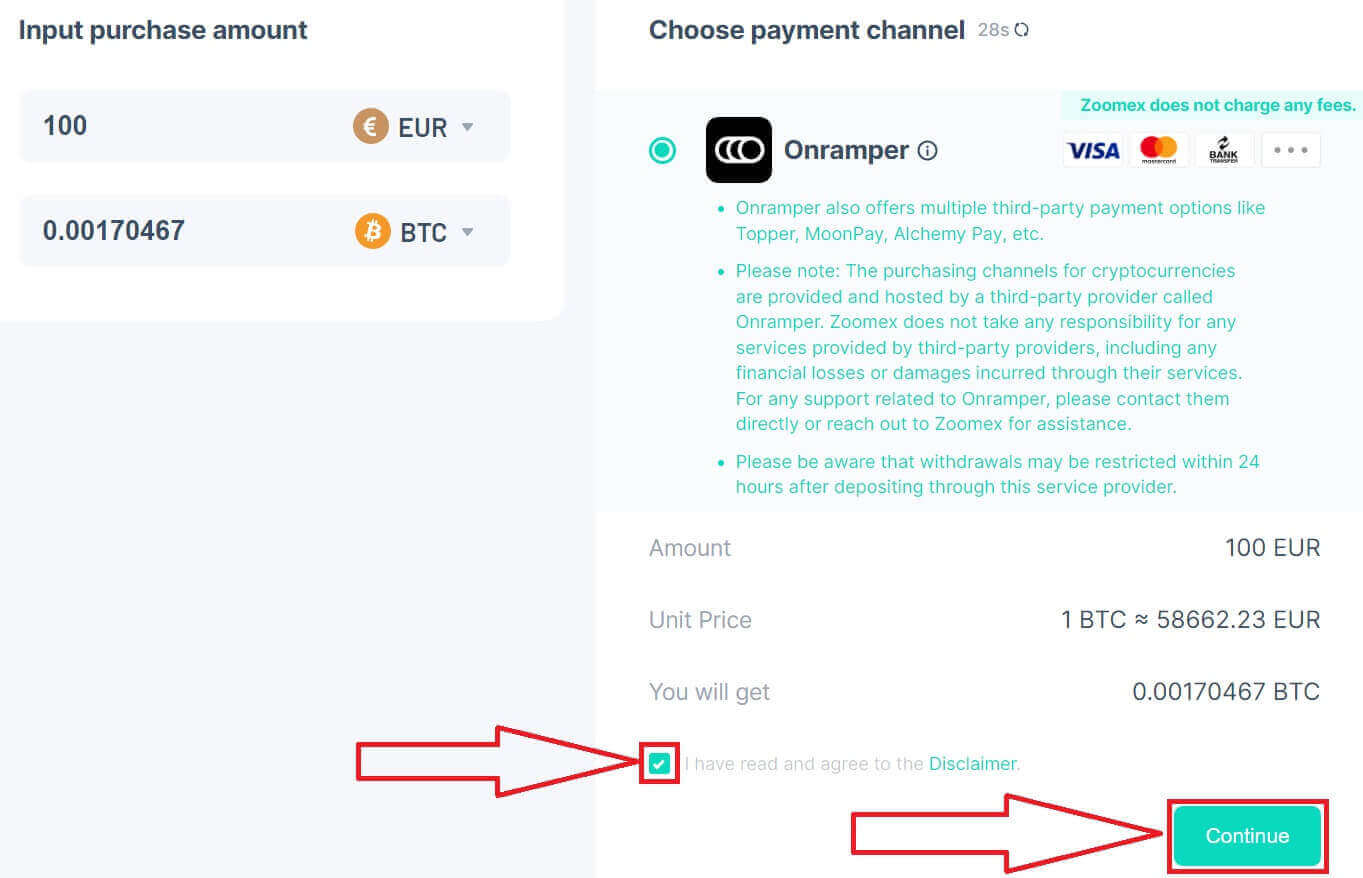

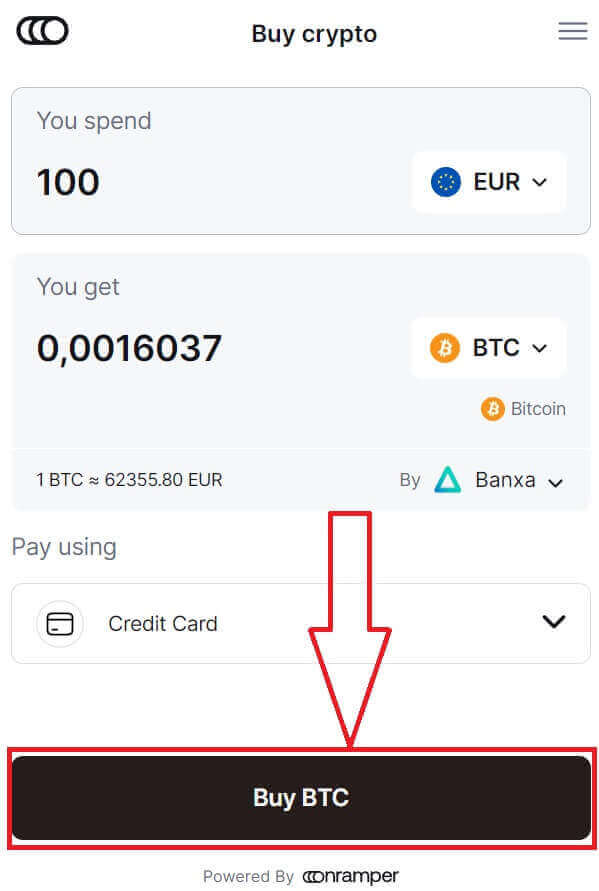

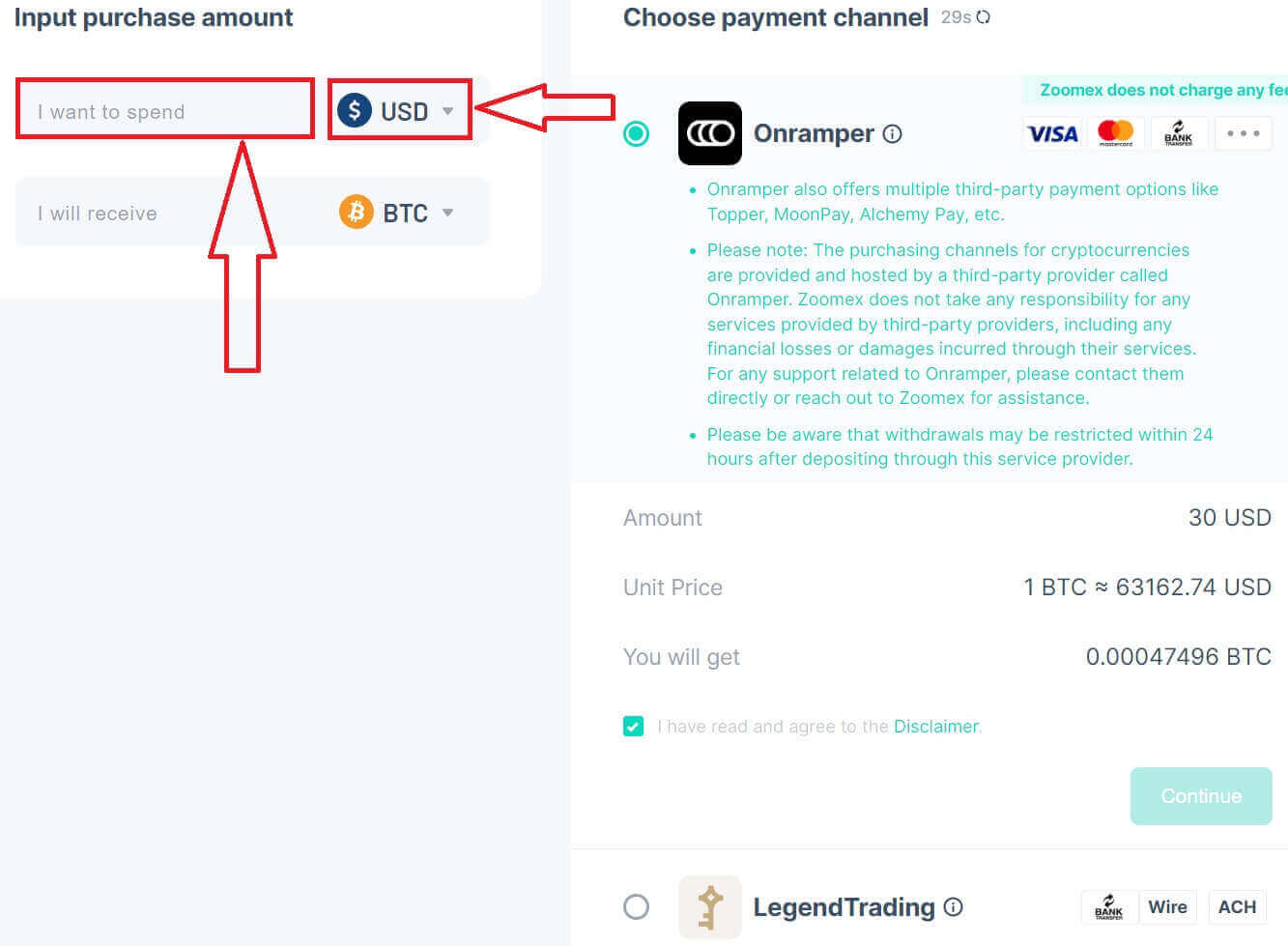

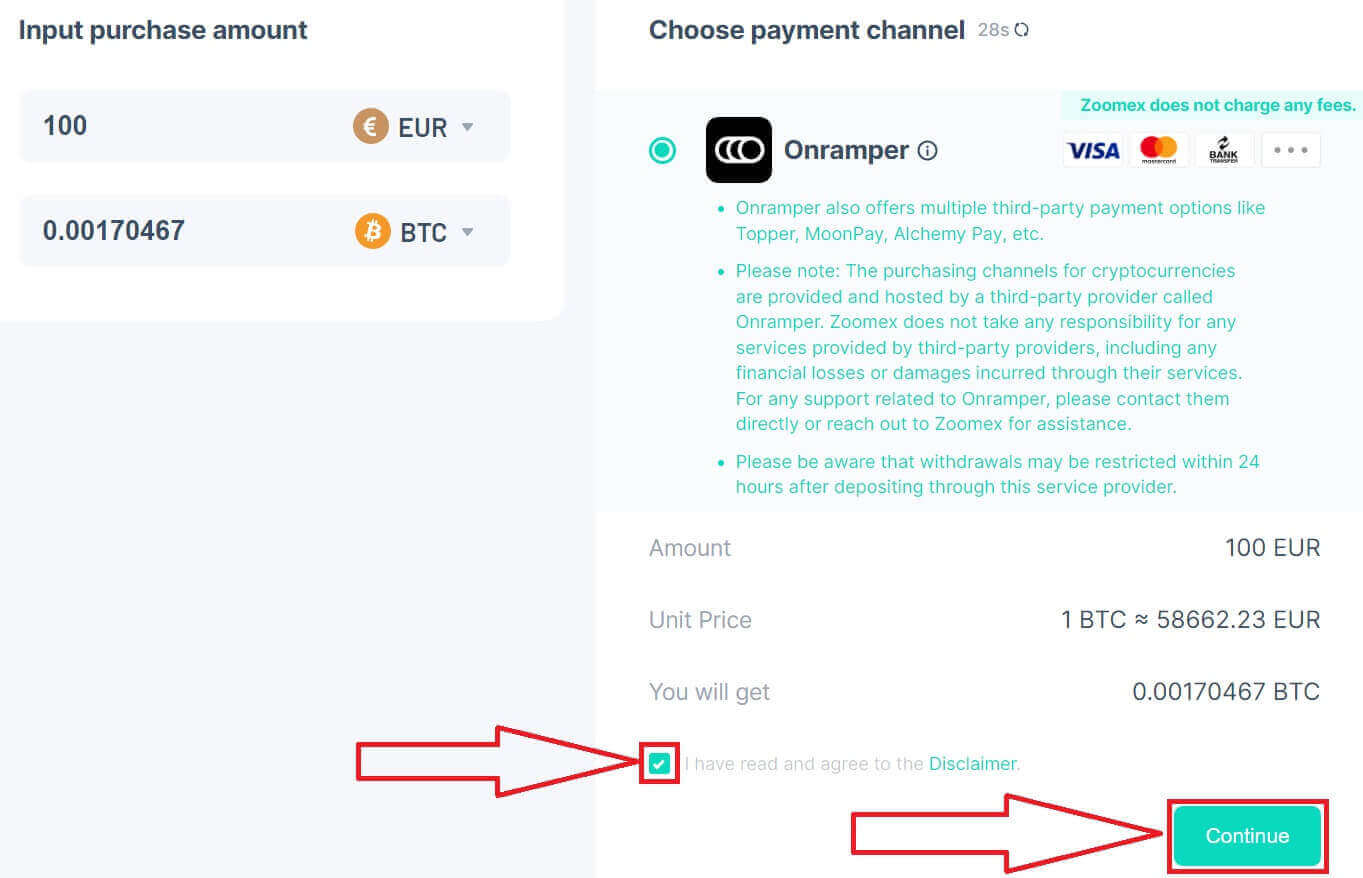

3. A pop-up window will come up, and you can choose the fiat currency that you want to pay, and the types of coins you prefer. It will convert it into the amount of coins that you will receive.

4. For example, if I want to buy 100 EUR of BTC, I type 100 in the [I want to spend] section, and the system will convert it automatically for me. Tick on the box to confirm you have read and agree to the Disclaimer. Click on [Continue] to continue.

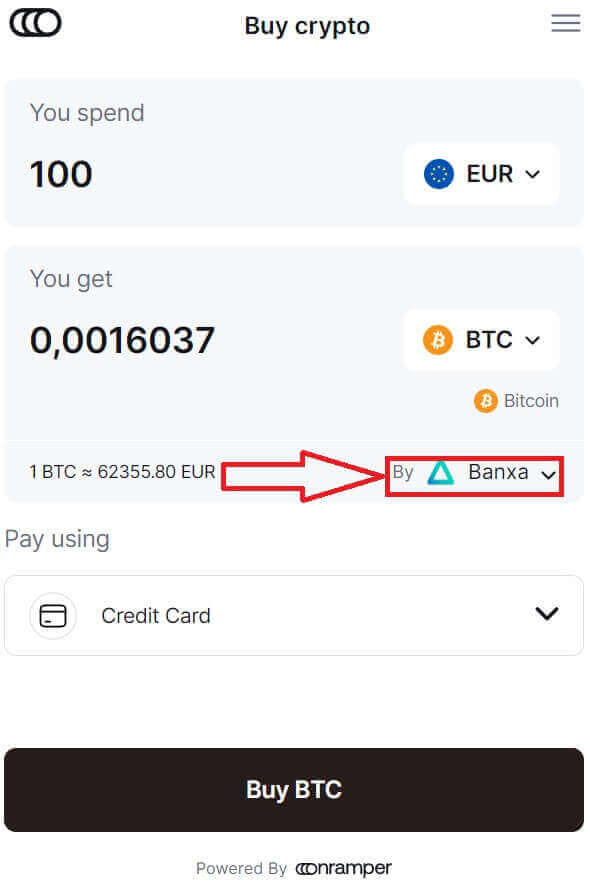

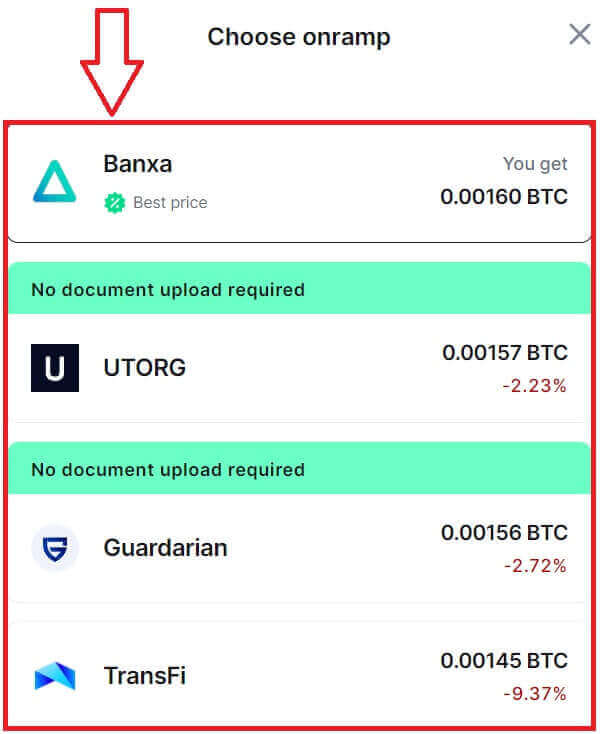

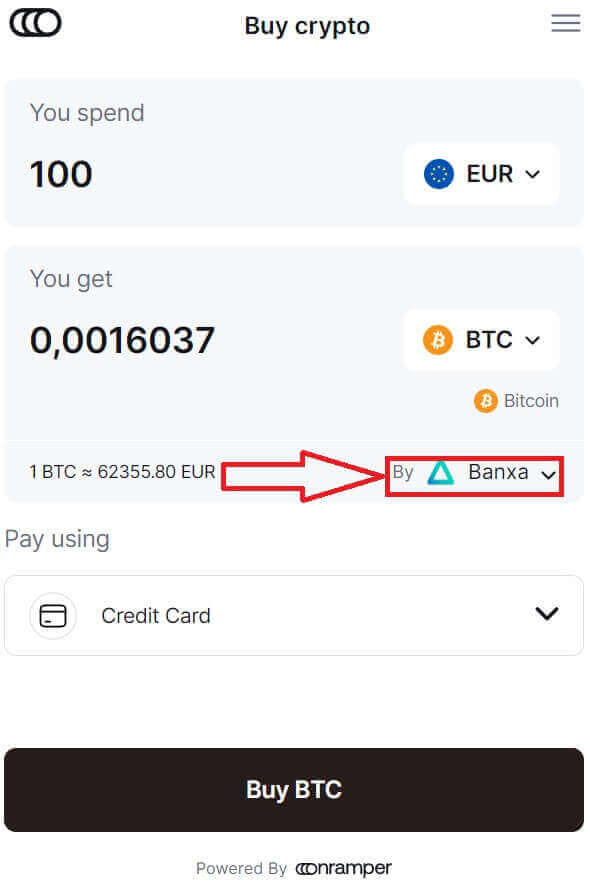

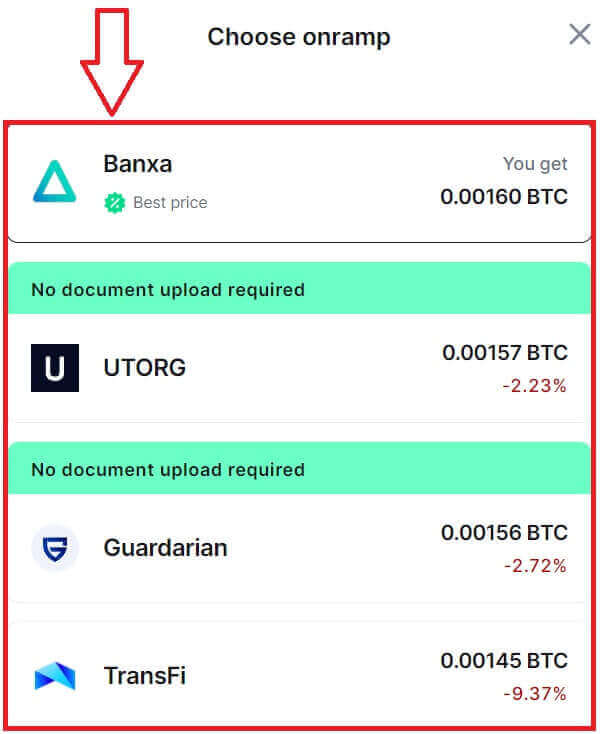

5. You could also choose the Provider, different providers will offer different deals for the convert.

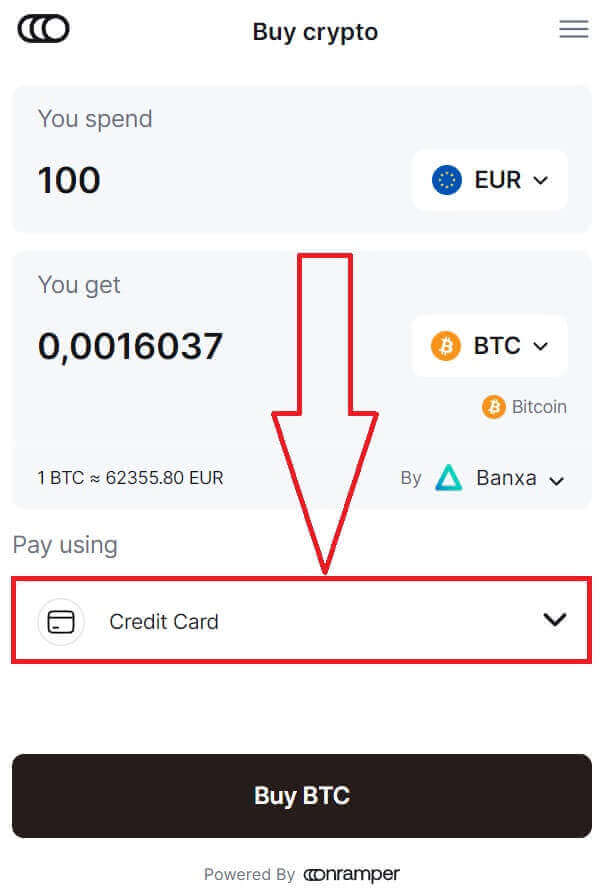

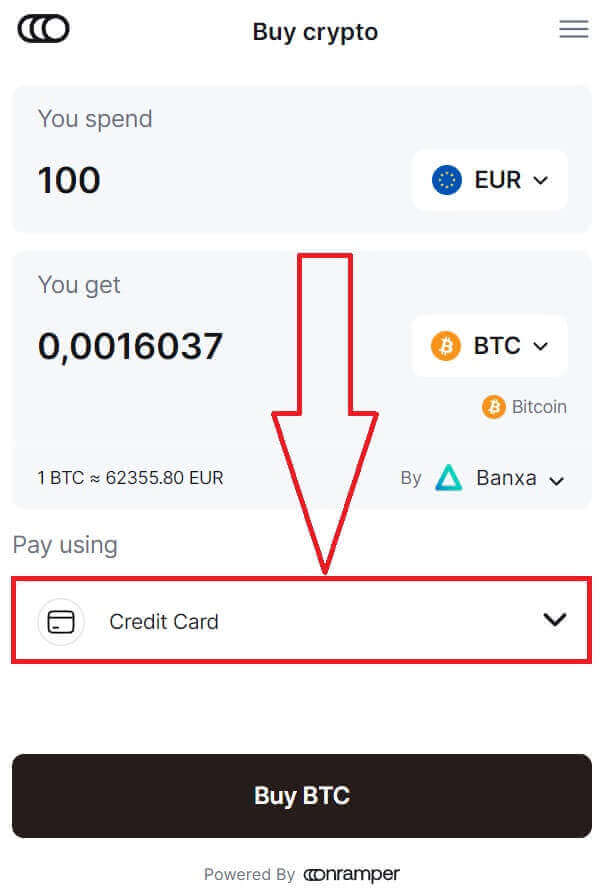

6. Click on the [Pay using] to select the payment method.

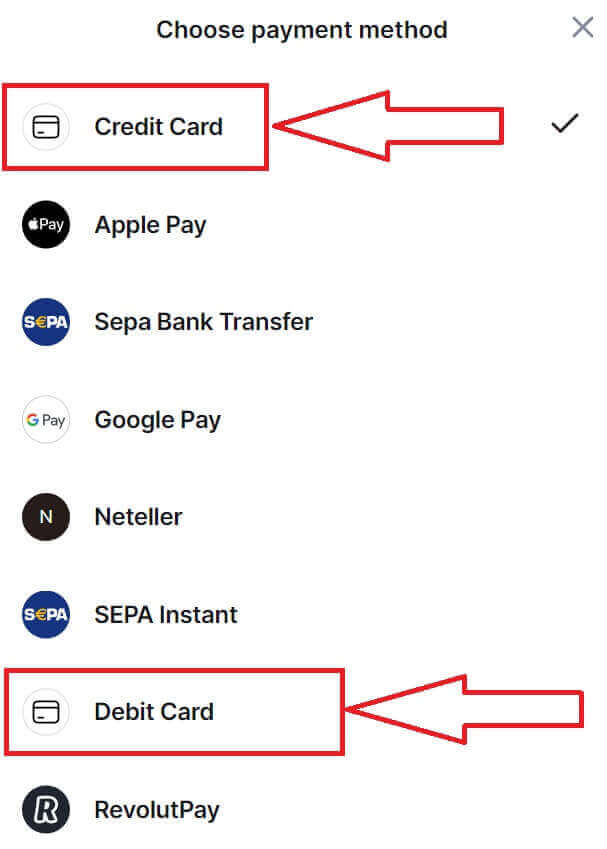

7. Choose [Credit Card] or [Debit Card].

8. Click on [Buy BTC] to complete the process.

How to Buy Crypto with Bank Transfer on Zoomex

1. Go to the Zoomex website and click on [Buy Crypto].

2. Select [Express] to continue.

3. A pop-up window will come up, and you can choose the fiat currency that you want to pay, and the types of coins you prefer. It will convert it into the amount of coins that you will receive.

4. For example, if I want to buy 100 EUR of BTC, I type 100 in the [I want to spend] section, and the system will convert it automatically for me. Tick on the box to confirm you have read and agree to the Disclaimer. Click on [Continue] to continue.

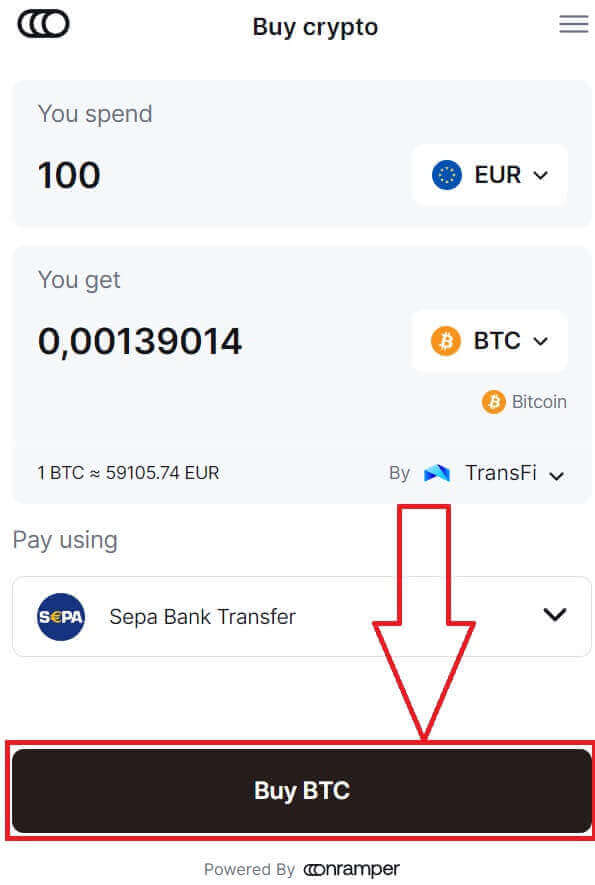

5. You could also choose the Provider, different providers will offer different deals for the convert.

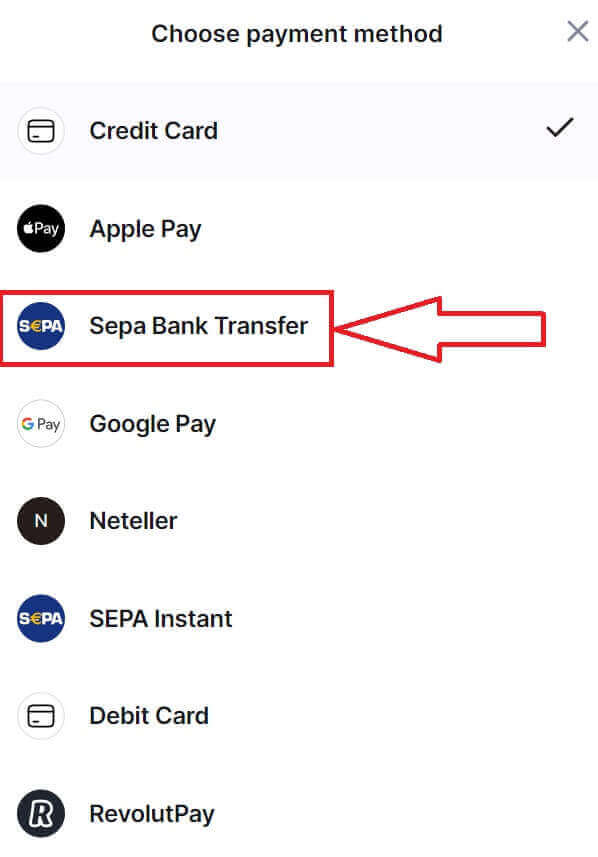

6. Click on the [Pay using] to select the payment method.

7. Choose [Sepa Bank Transfer] to continue.

8. Click on [Buy BTC] to complete the process.

How to Buy Crypto with Slash on Zoomex

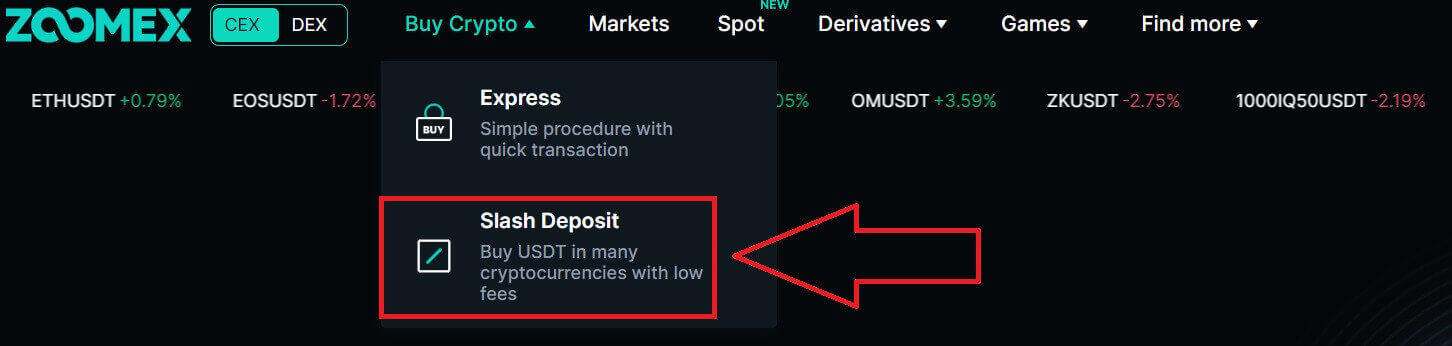

1. Go to the Zoomex website and click on [Buy Crypto]. Select [Slash Deposit].

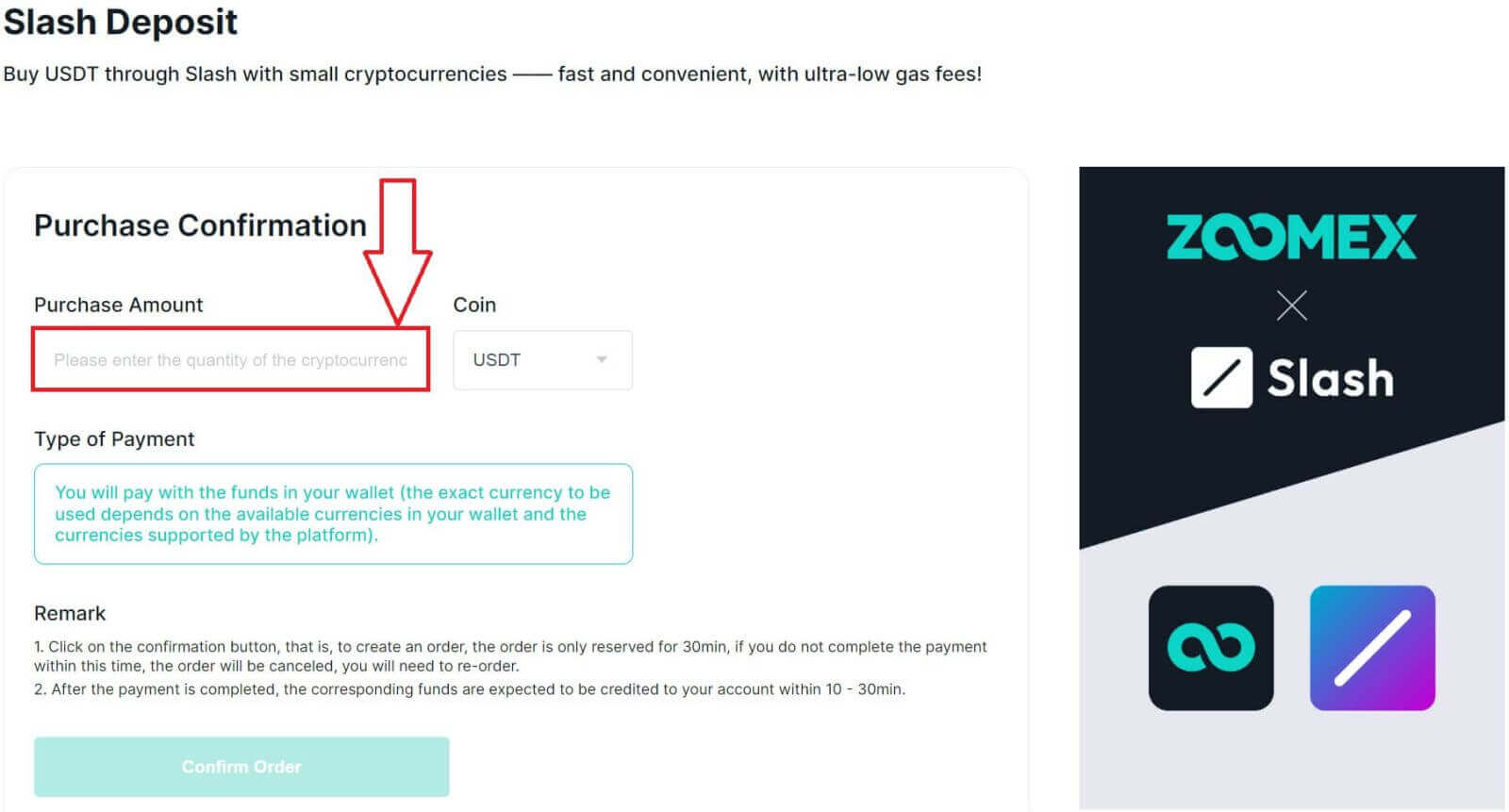

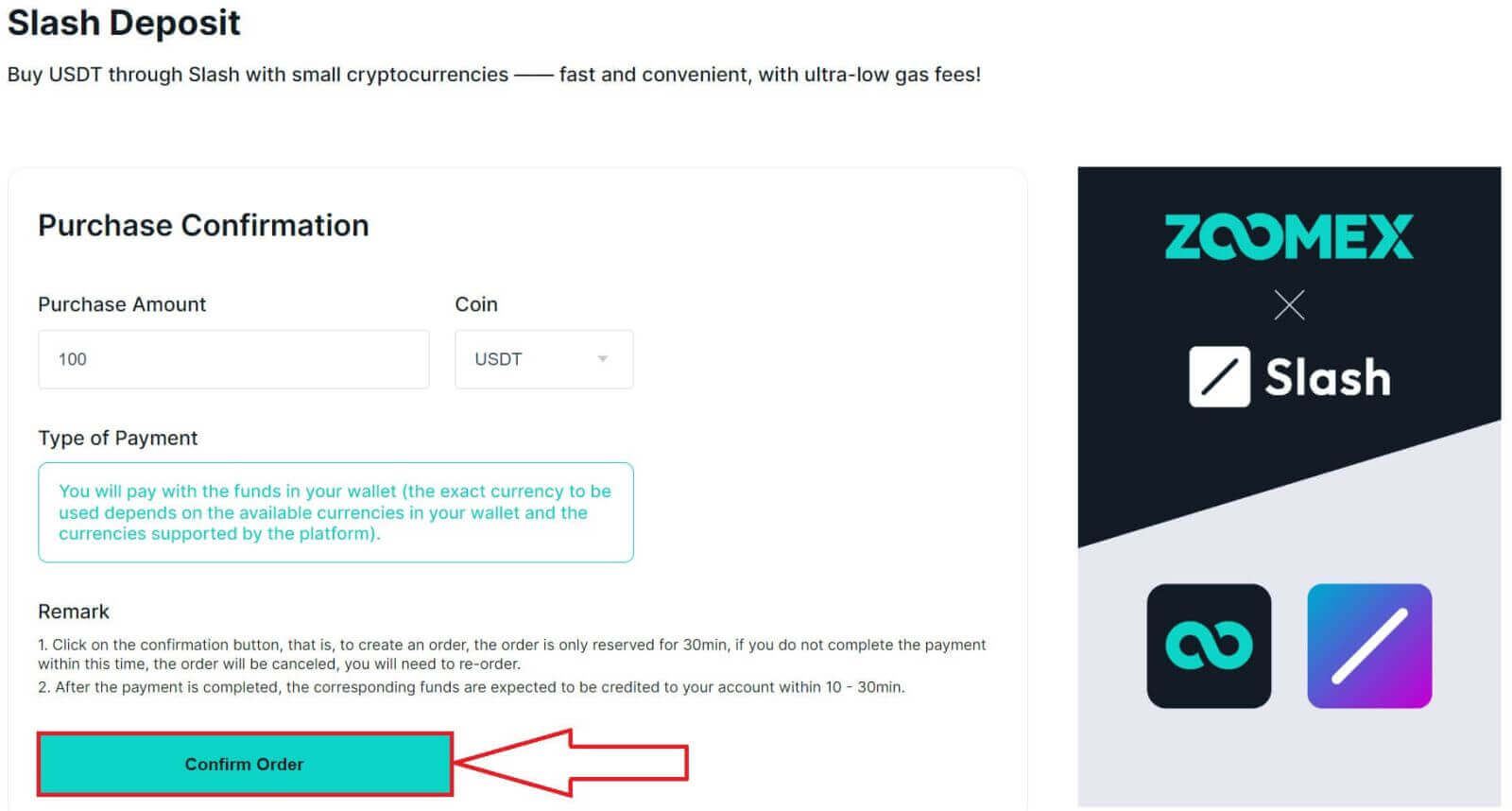

2. Type in the Amount of USDT that you want to purchase.

3. For example, if I want to buy 100 USDT, I will type 100 in the blank, and then click on [Confirm Order] to finish.

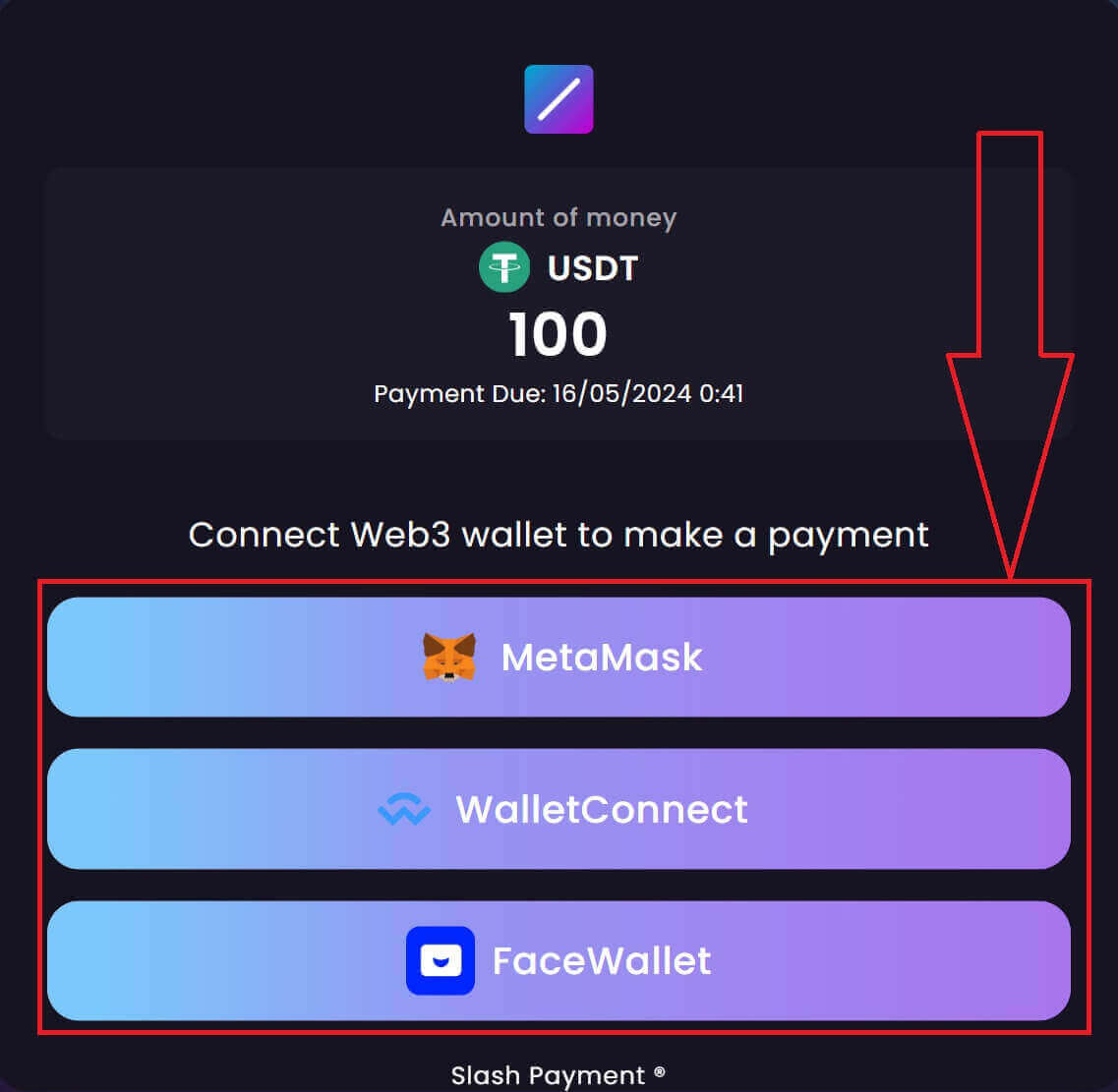

4. After that, a pop-up transaction window will come up. Choose Web3 wallet to make a payment.

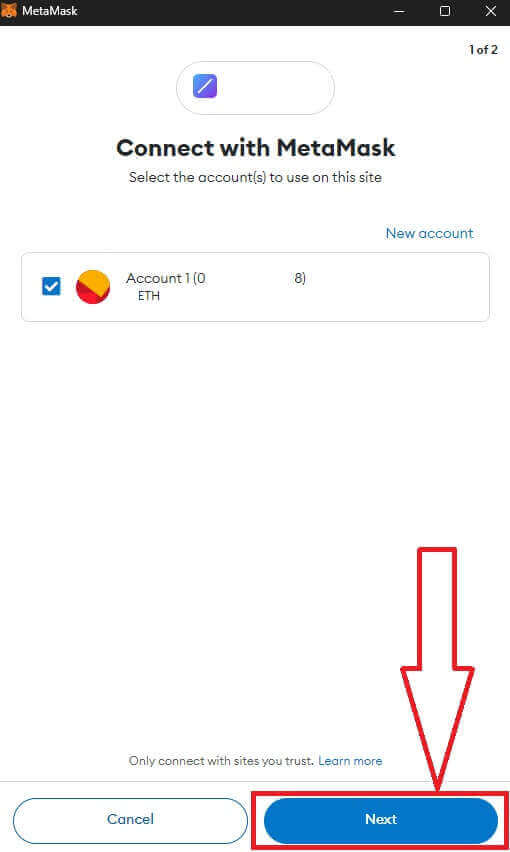

5. For example here I am choosing metamask for the transaction, I need to connect my wallet with Splash. Choose the account and Click on [Next] to continue.

6. Click on [Connect] to connect your wallet to do the payment.

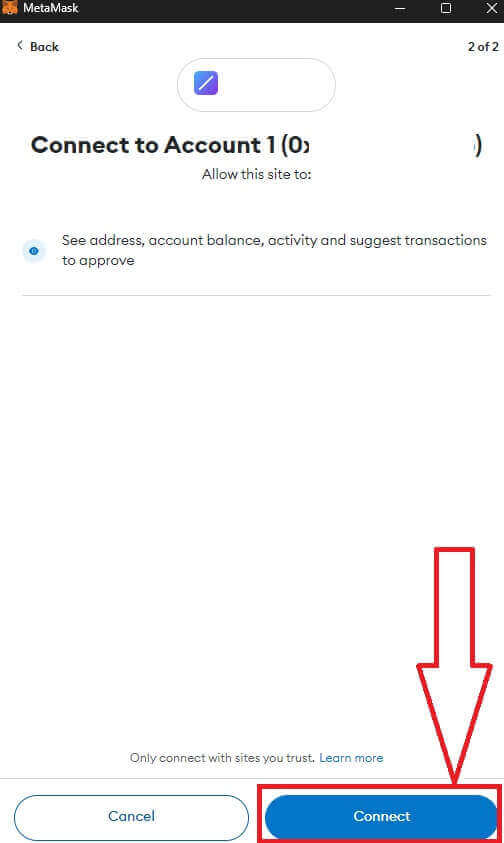

7. Then select the network that you prefer to do the payment, after that confirm the payment to complete deposit by yourself.

How to Deposit Crypto on Zoomex

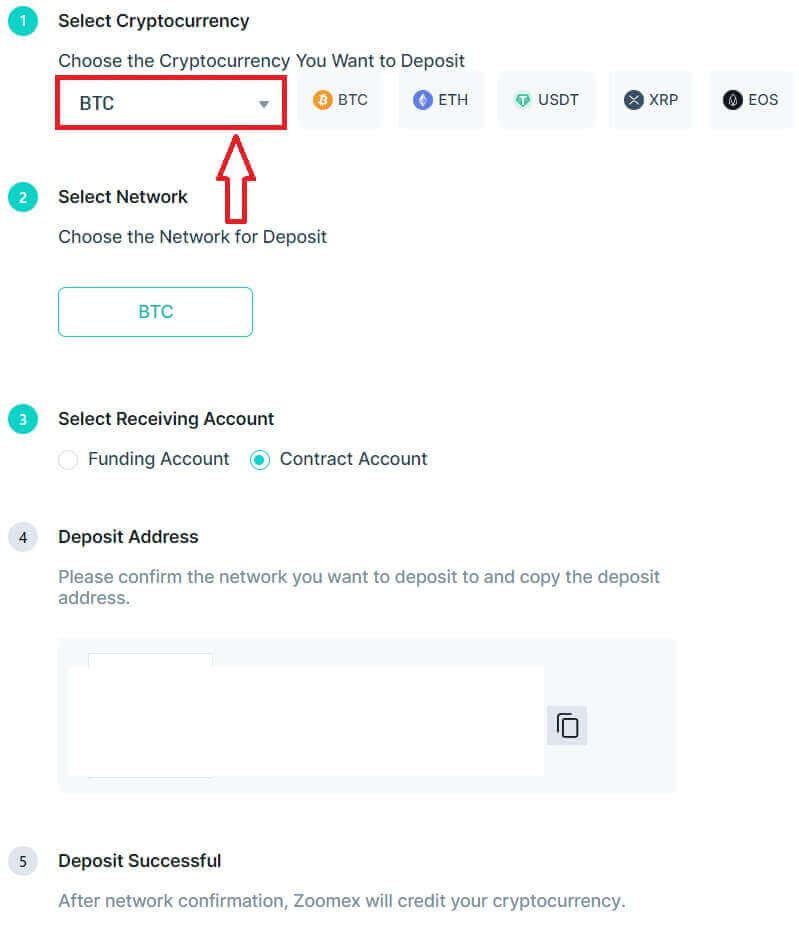

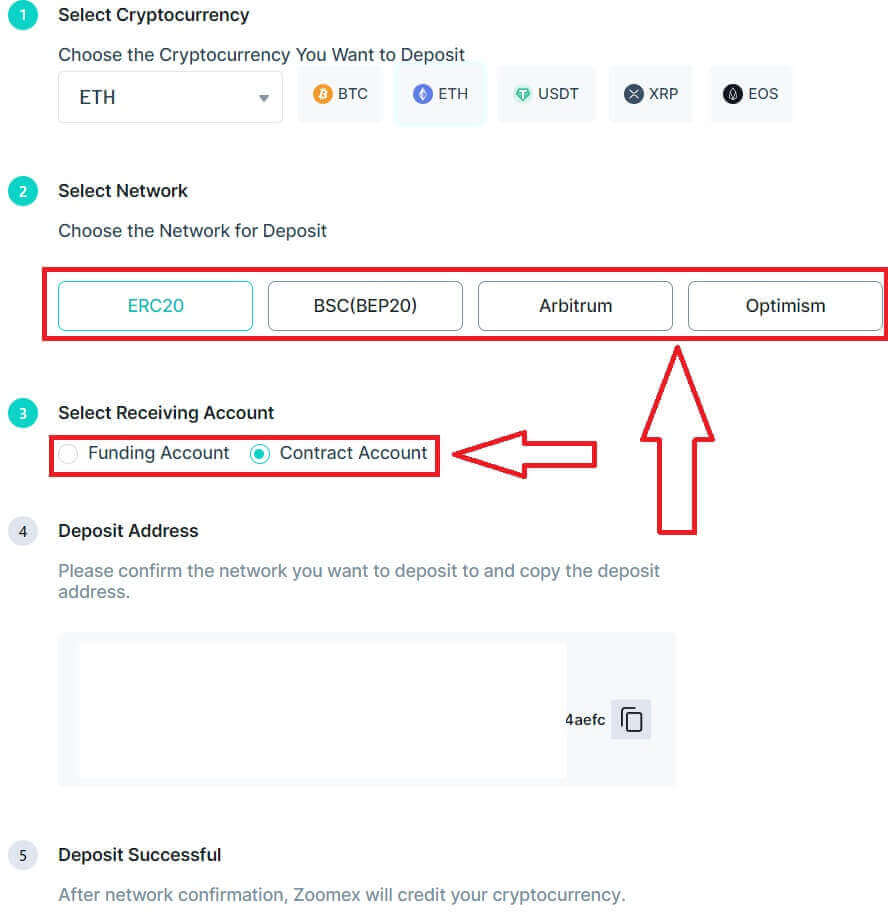

Deposit Crypto on Zoomex (Web)

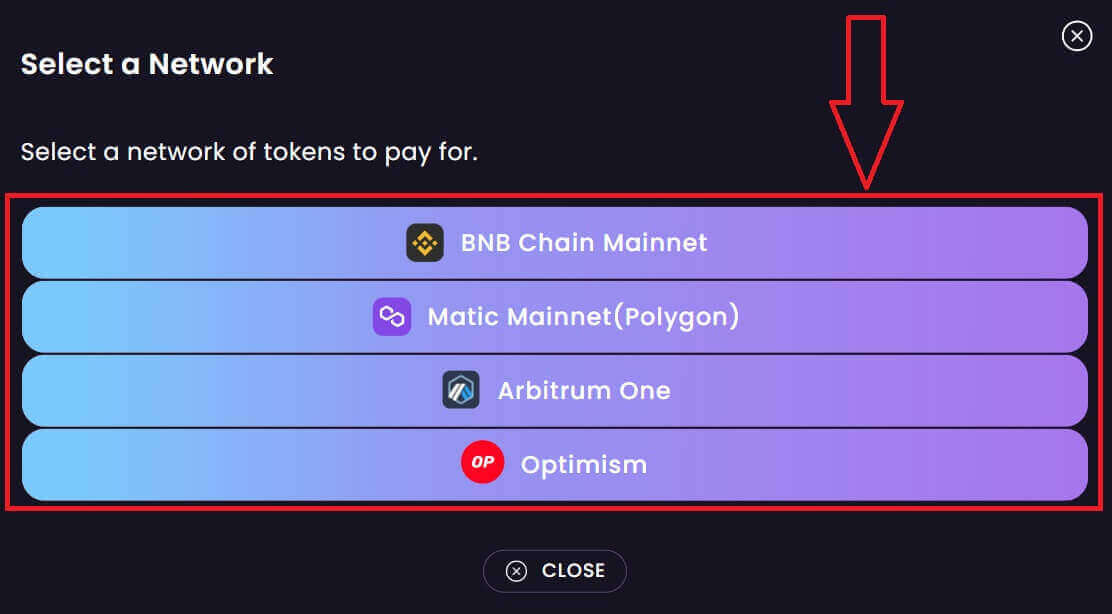

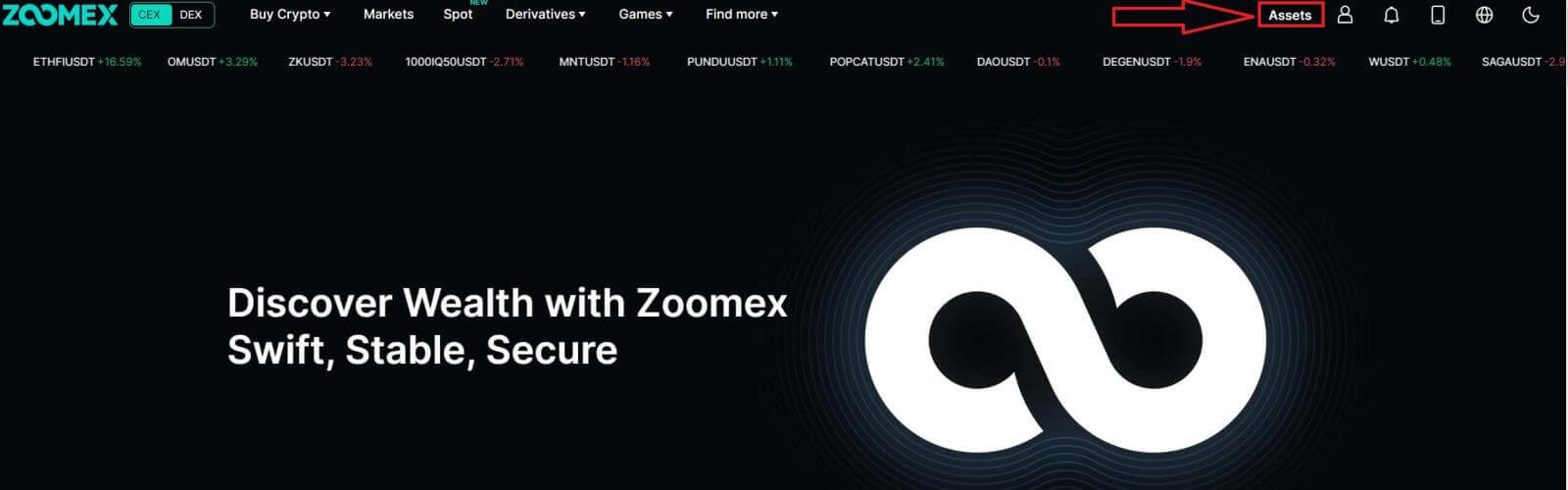

1. Click on the [Assets] to continue.

2. Click on [Deposit] to start to receive your deposit address.

3. Select your cryptocurrency.

4. Select the Network and receiving account for the deposit.

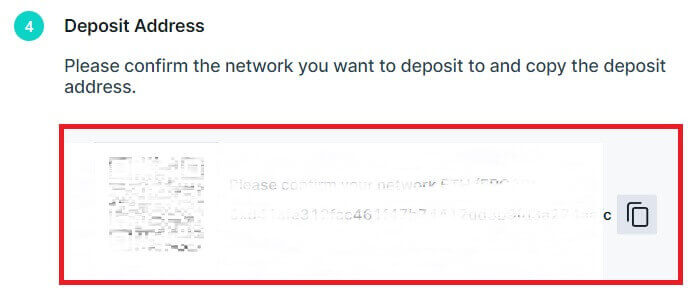

5. For example here, if I want to deposit ETH with the ERC20 Network, I will choose ETH as the Cryptocurrency, ERC20 in the network section, and choose the Receiving Account as my Contract Account, after all, I will receive my address as QR code or you could also copy it for easier use.

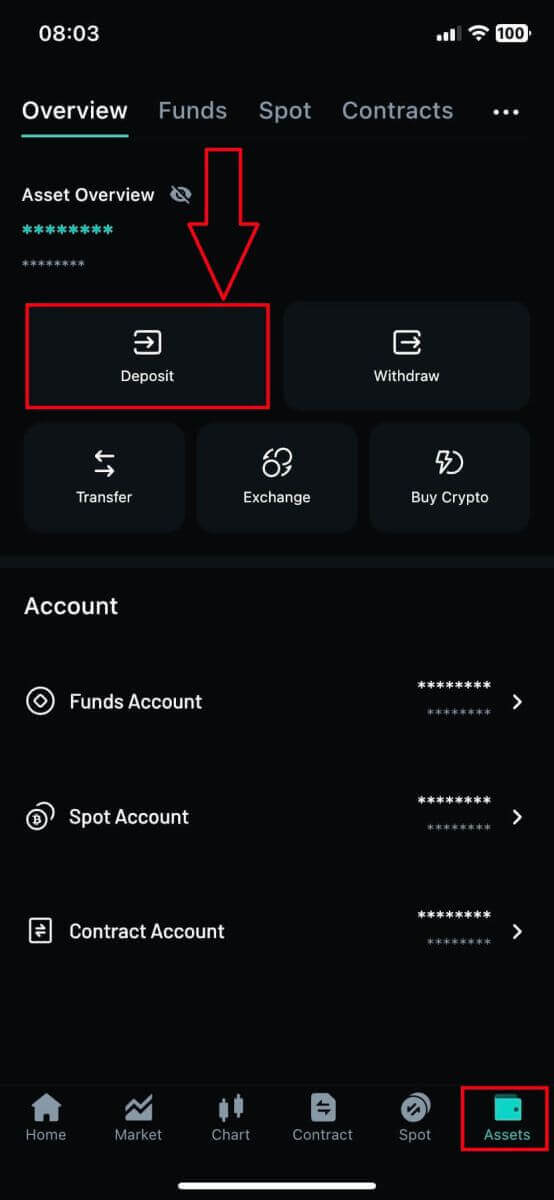

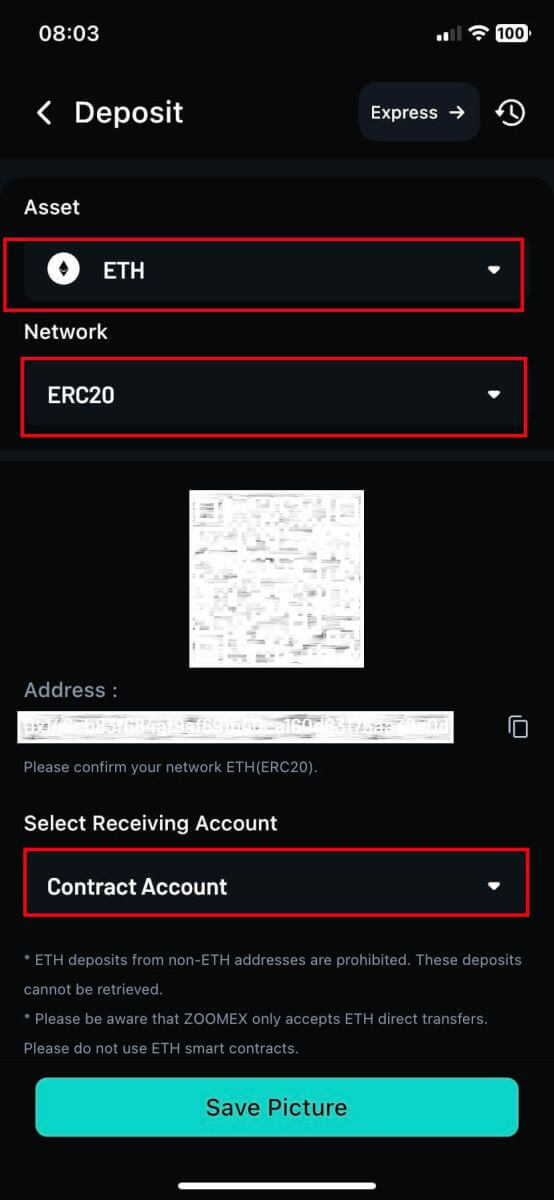

Deposit Crypto on Zoomex (App)

1. Click on the [Assets] to continue.

2. Click on [Deposit] to start to receive your deposit address.

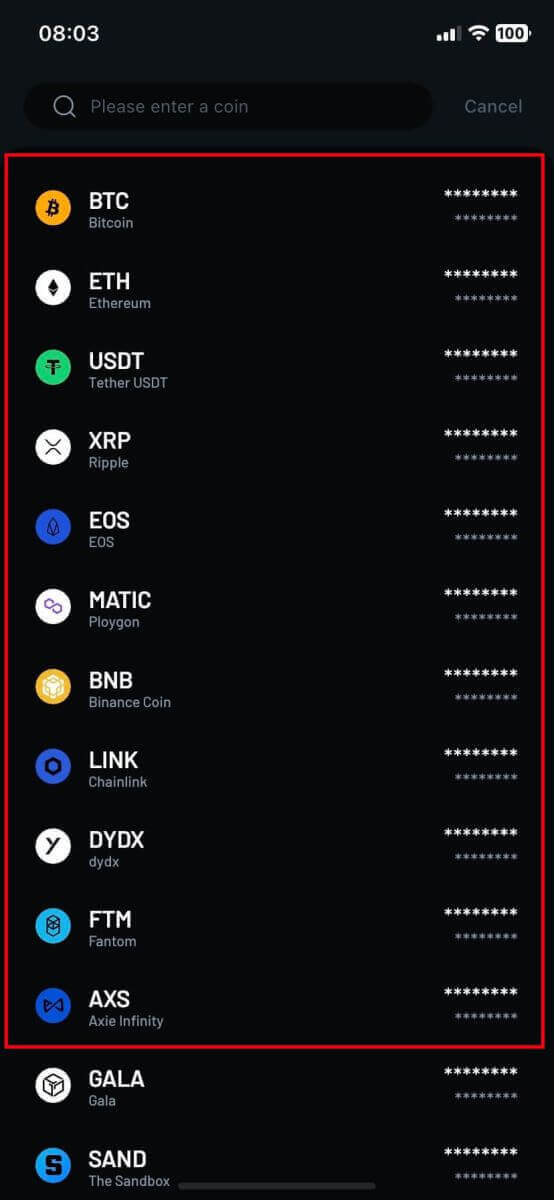

3. Select your cryptocurrency.

4. Select the Network for the deposit. For example here, if I want to deposit ETH with the ERC20 Network, I will choose ETH as the Cryptocurrency, ERC20 in the network section, and choose the Receiving Account as my Contract Account, after all, I will receive my address as QR code or you could also copy it for easier use.

Frequently Asked Questions (FAQ)

Is my asset safe when deposited in Zoomex?

You don’t need to worry about the safety of your assets. Zoomex stores user assets in a multi-signature wallet. Withdrawal requests from individual accounts undergo rigorous inspection. Manual reviews for withdrawals exceeding the immediate withdrawal limit are conducted daily at 4 PM, 12 AM, and 8 AM (UTC). Additionally, user assets are managed separately from Zoomex operational funds.

How do I make a deposit?

There are two different ways of making a deposit.

1. Create an account on a spot trading platform, purchase coins, and then deposit them into Zoomex.

2. Contact individuals or businesses selling coins over the counter (OTC) to purchase coins.

Q) Why hasn’t my deposit been reflected yet? (Coin-specific issues)

ALL COINS (BTC, ETH, XRP, EOS, USDT)

1. Insufficient number of Blockchain Confirmations

The insufficient number of blockchain confirmations is the reason for the delay. Deposits must meet the confirmation conditions listed above to be credited to your account.

2. Unsupported Coin or Blockchain

You deposited using an unsupported coin or blockchain. Zoomex supports only the coins and blockchains displayed on the assets page. If, unintentionally, you deposit an unsupported coin in the Zoomex wallet, the Client Support team can assist in the asset recovery process, but please note there is no guarantee of 100% recovery. Also, please note that there are fees associated with unsupported coin and blockchain transactions.

XRP/EOS

Missing/Wrong Tag or Memo

You may not have entered the correct tag/memo when depositing XRP/EOS. For XRP/EOS deposits, since the deposit addresses for both coins are the same, entering the accurate tag/memo is essential for a trouble-free deposit. Failure to input the correct tag/memo may result in not receiving the XRP/EOS assets.

ETH

Deposit via Smart Contract

You deposited through a smart contract. Zoomex does not yet support deposits and withdrawals through smart contracts, so if you deposited via a smart contract, it won’t be automatically reflected in your account. All ERC-20 ETH deposits must be made through direct transfer. If you’ve already deposited through a smart contract, please send the coin type, amount, and TXID to our Client Support team at [email protected]. Once the inquiry is received, normally we can manually process the deposit within 48 hours.

Does Zoomex have a minimum deposit limit?

There is no minimum deposit limit.

I accidentally deposited an unsupported asset. What should I do?

Please check the withdrawal TXID from your wallet and send the deposited coin, quantity, and TXID to our Client Support team at [email protected]

How to Trade Crypto at Zoomex

What is Spot trading?

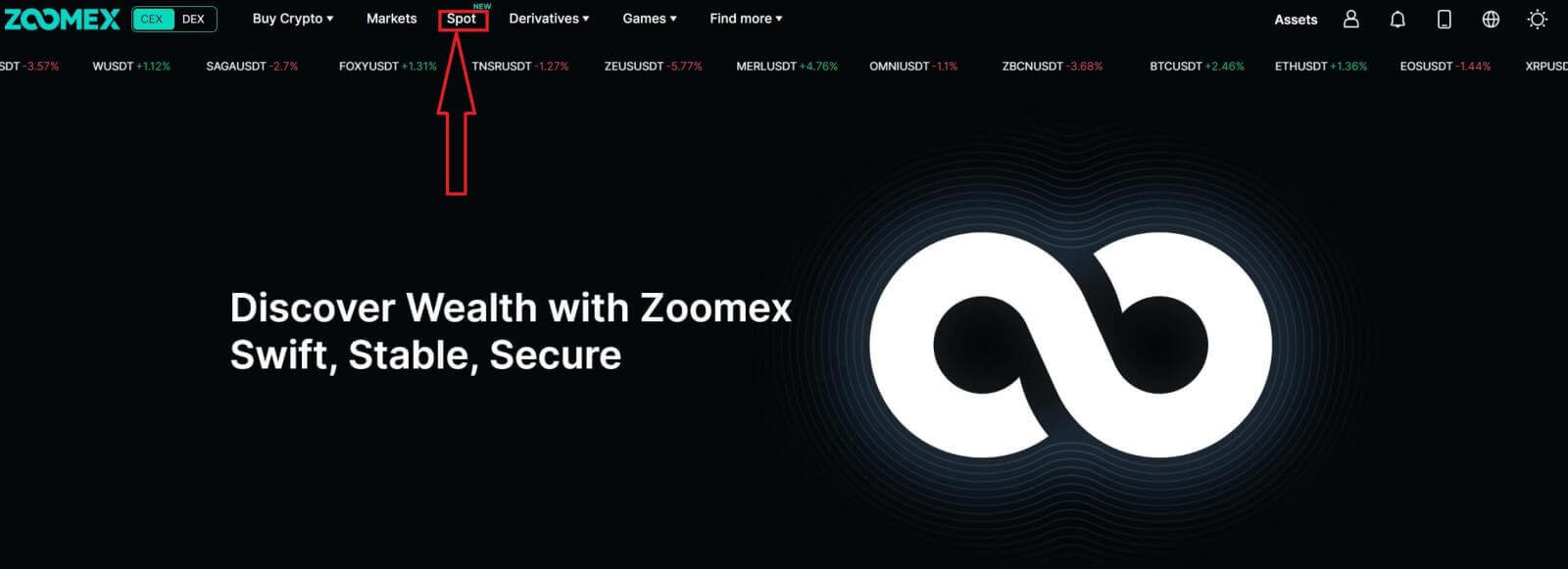

Spot trading refers to the buying and selling of tokens and coins at the current market price with immediate settlement. Trading spot is different from derivatives trading, as you need to own the underlying asset to place a buy or sell order.How to Trade Spot on Zoomex (Web)

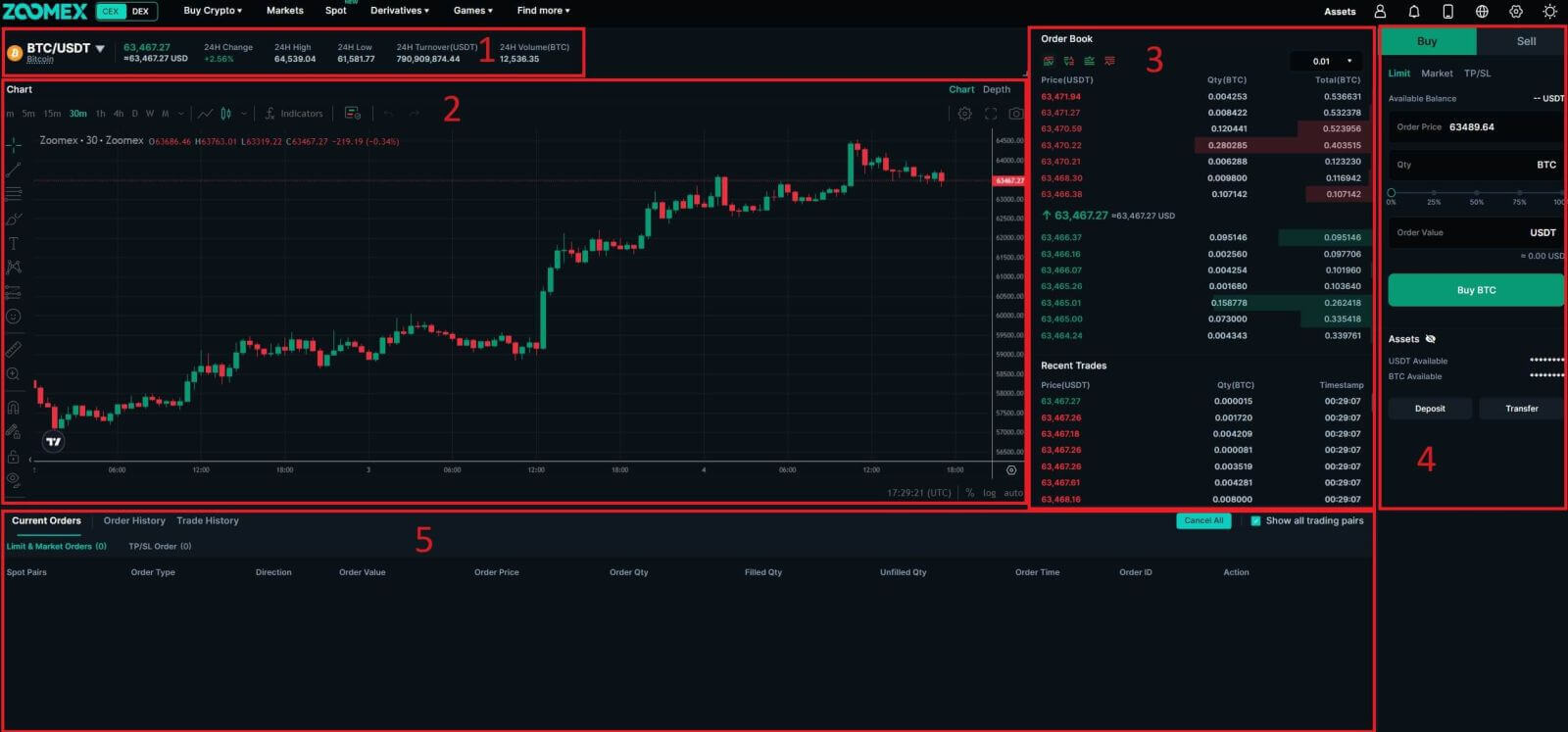

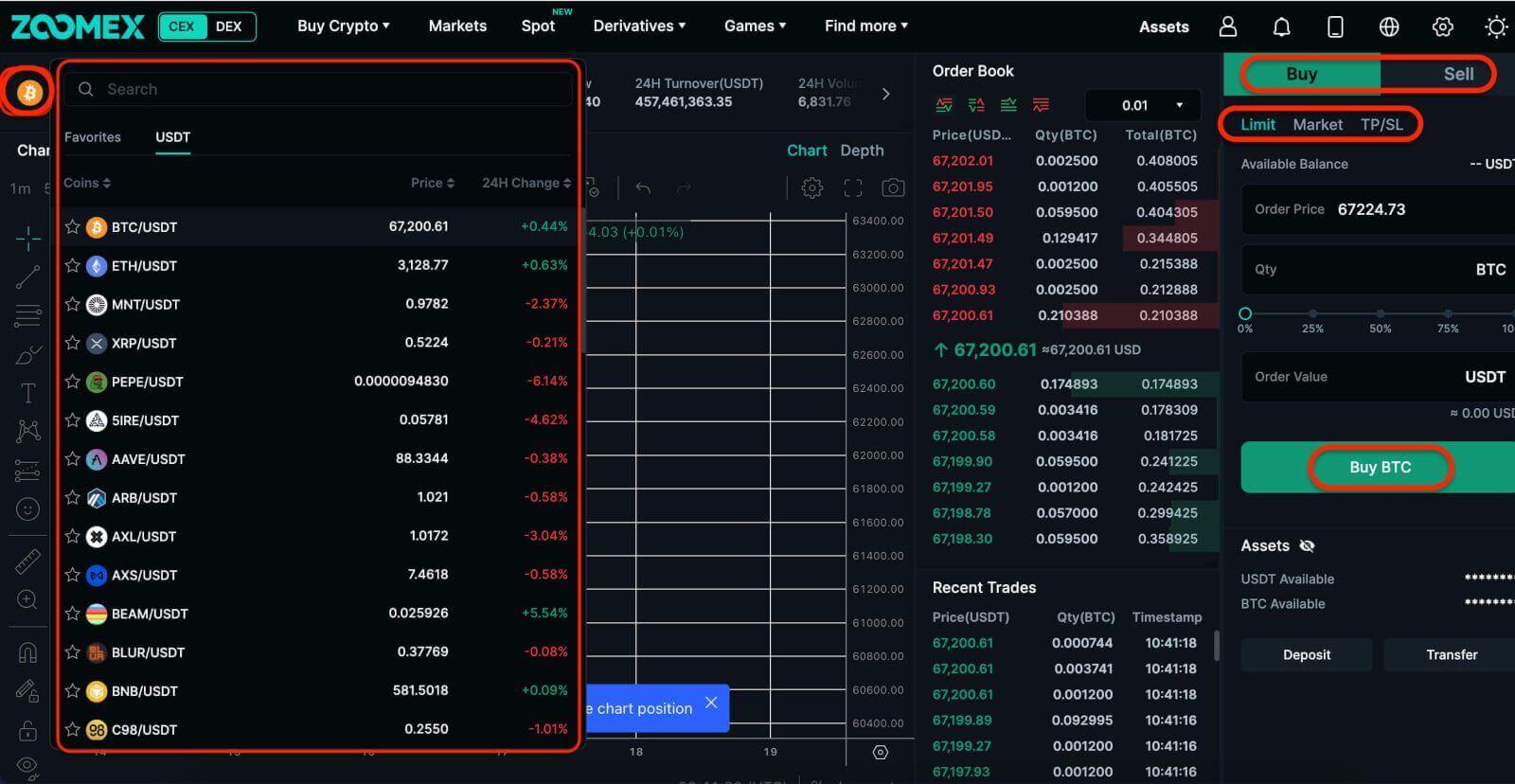

1. Open the Zoomex website and log in. Click on [Spot] to continue. 2. This is a view of Zoomex’s trading page interface.

2. This is a view of Zoomex’s trading page interface.

-

The trading volume of Spot Pairs in 24 hours:

This refers to the total volume of trading activity that has occurred within the last 24 hours for specific spot pairs (e.g., BTC/USD, ETH/BTC).

-

Candlestick Chart:

Candlestick charts are graphical representations of price movements over a specific period. They display opening, closing, and high, and low prices within the chosen timeframe, helping traders analyze price trends and patterns.

-

Order Book:

The order book displays a list of all open buy and sell orders for a particular cryptocurrency pair. It shows the current market depth and helps traders gauge supply and demand levels.

-

Buy/Sell Section:

This is where traders can place orders to buy or sell cryptocurrencies. It typically includes options for market orders (executed immediately at the current market price) and limit orders (executed at a specified price).

-

Current Orders/Order History/Trade History:

Traders can view their Current Order, Order History, and Trade History, including details such as entry price, exit price, profit/loss, and time of trade.

- Limit Order:

- Market Order:

- TP/SL (Take profit - Stop limit)

- A Market order will be filled immediately at the best available market price.

- A Limit order will be submitted to the order book and will wait for execution at the specified order price. If the best bid/ask price is better than the order price, the Limit order may be executed immediately at the best bid/ask price. Therefore, traders should exercise caution with the non-guaranteed execution of Limit orders, as it depends on price movement and order book liquidity.

4. Choose the crypto you want to operate on the left crypto column. Then choose the trading type: [Buy] or [Sell] and the order type [Limit Order], [Market Order], [TP/SL].

- Limit Order:

- TP/SL Order:

Example: Assuming the current BTC price is 65,000 USDT, here are some scenarios for TP/SL orders with different triggers and order prices.

| TP/SL Market Sell Order Trigger Price: 64,000 USDT Order Price: N/A |

When the last traded price reaches the TP/SL trigger price of 64,000 USDT, the TP/SL order will be triggered, and a Market sell order will be placed immediately, selling the assets at the best available market price. |

| TP/SL Limit Buy Order Trigger Price: 66,000 USDT Order Price: 65,000 USDT |

When the last traded price reaches the TP/SL trigger price of 66,000 USDT, the TP/SL order will be triggered, and a Limit buy order with 65,000 USDT order price will be placed into the order book, awaiting execution. Once the last traded price reaches 65,000 USDT, the order will be executed. |

| TP/SL Limit Sell Order Trigger Price: 66,000 USDT Order Price: 66,000 USDT |

When the last traded price reaches the TP/SL trigger price of 66,000 USDT, the TP/SL order is triggered. Assuming the best bid price is 66,050 USDT after the trigger, the Limit sell order will be executed immediately at a price better (higher) than the order price, which is 66,050 USDT in this case. However, if the price drops below the order price upon triggering, a 66,000 USDT Limit sell order will be placed into the order book for execution. |

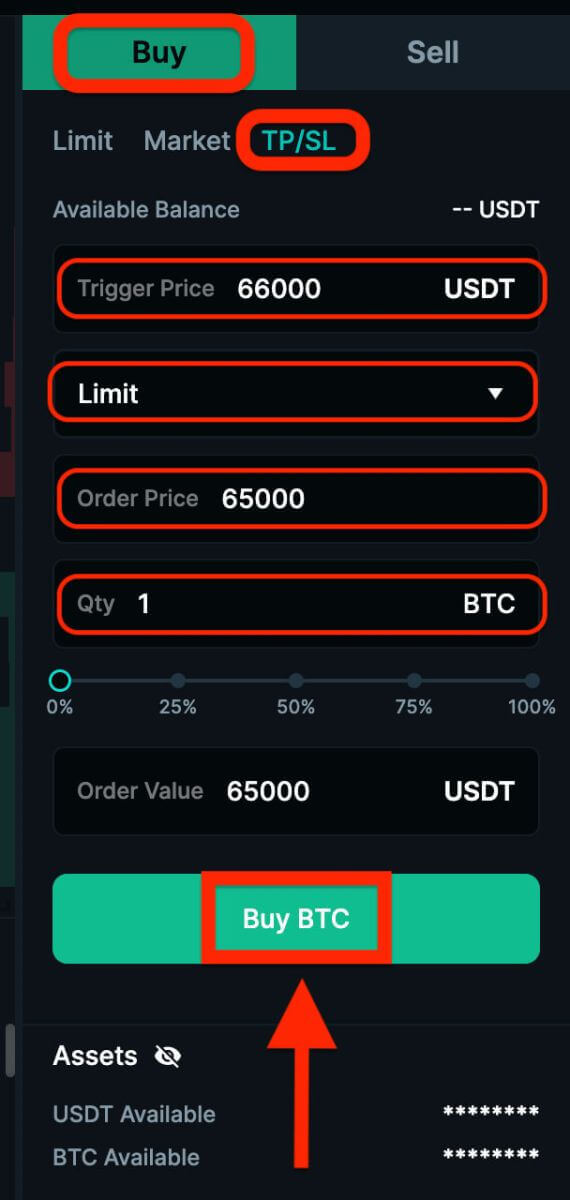

How to Trade Spot on Zoomex (App)

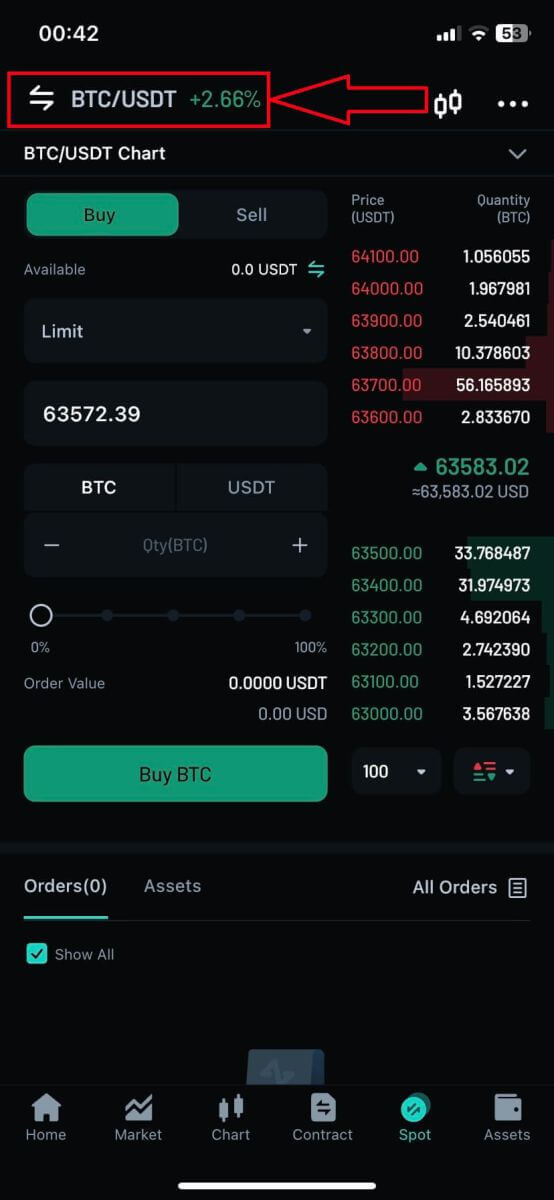

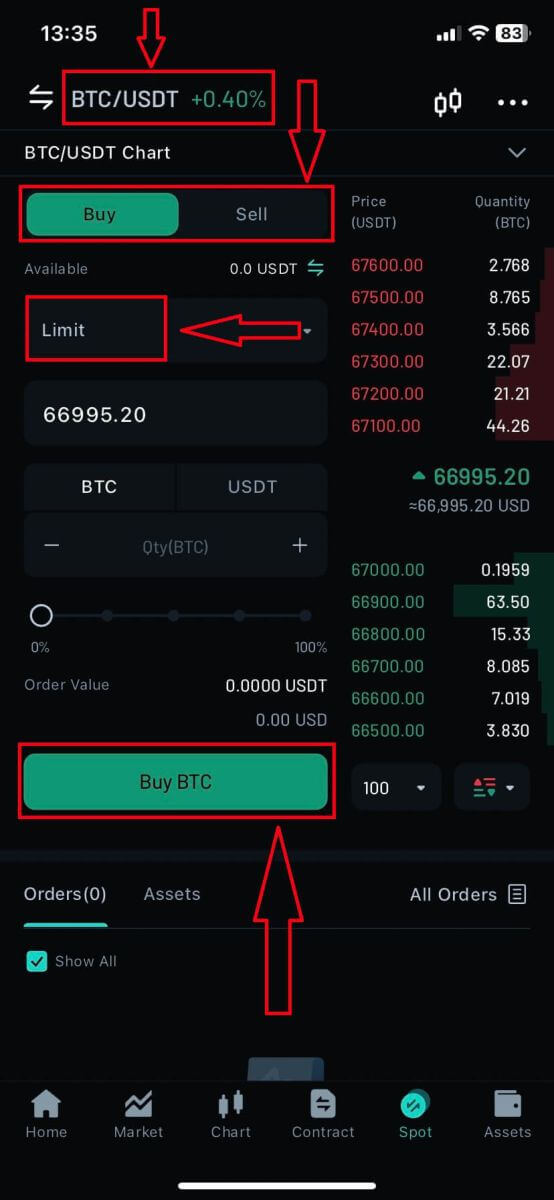

1. Open the Zoomex app and log in. Click on [Spot] to continue.

2. This is a view of Zoomex’s trading page interface.

-

The trading volume of Spot Pairs in 24 hours:

This refers to the total volume of trading activity that has occurred within the last 24 hours for specific spot pairs (e.g., BTC/USD, ETH/BTC).

-

Candlestick Chart:

Candlestick charts are graphical representations of price movements over a specific period. They display opening, closing, and high, and low prices within the chosen timeframe, helping traders analyze price trends and patterns.

-

Buy/Sell Section:

This is where traders can place orders to buy or sell cryptocurrencies. It typically includes options for market orders (executed immediately at the current market price) and limit orders (executed at a specified price).

-

Order Book:

The order book displays a list of all open buy and sell orders for a particular cryptocurrency pair. It shows the current market depth and helps traders gauge supply and demand levels.

-

Current Orders/Order History/Trade History:

Traders can view their Current Order, Order History, and Trade History, including details such as entry price, exit price, profit/loss, and time of trade.

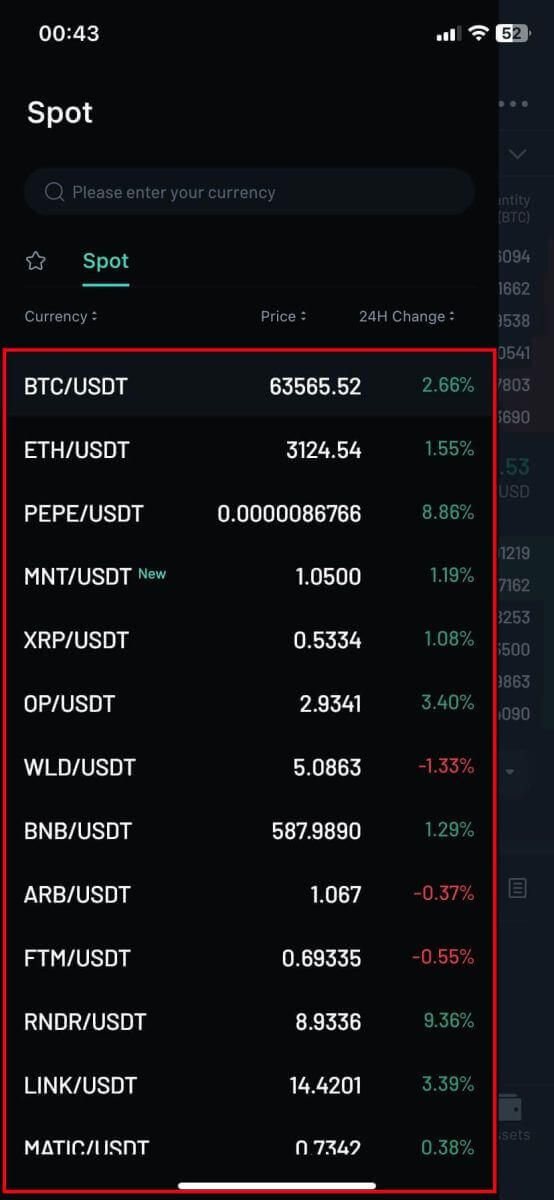

3. Choose the crypto you want to operate on the left crypto column.

4. Choose the Spot Pairs that you prefer.

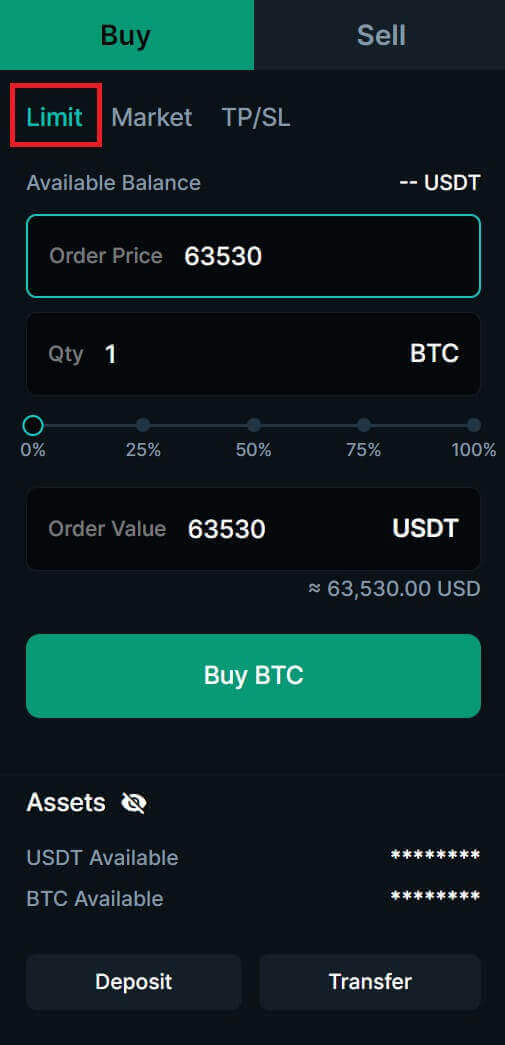

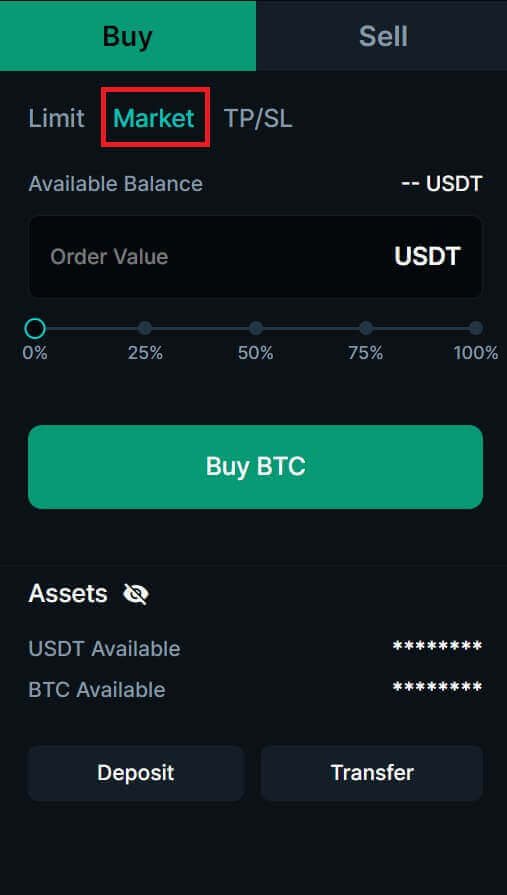

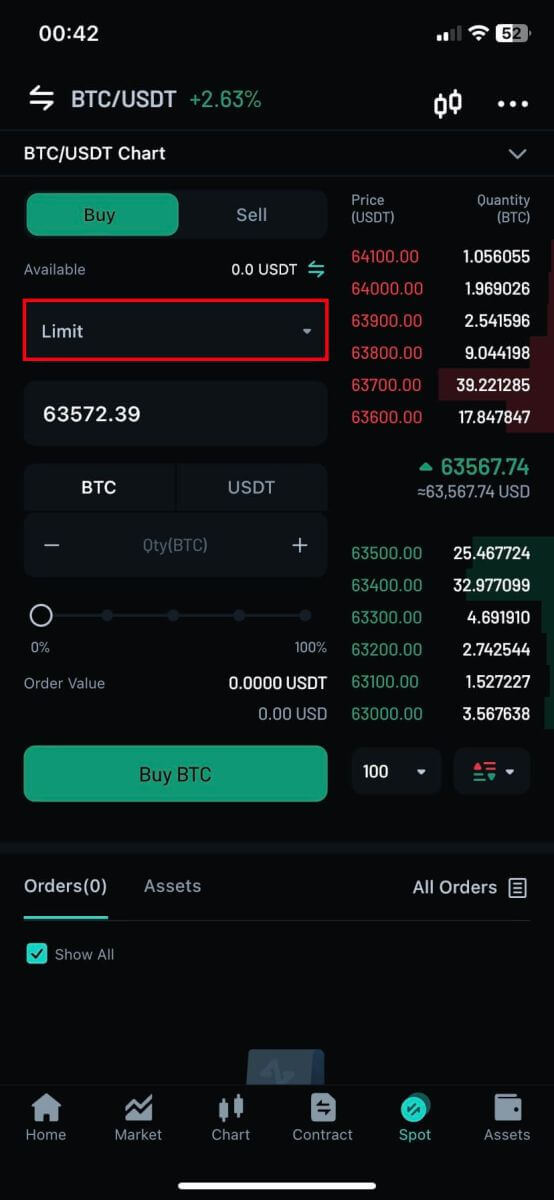

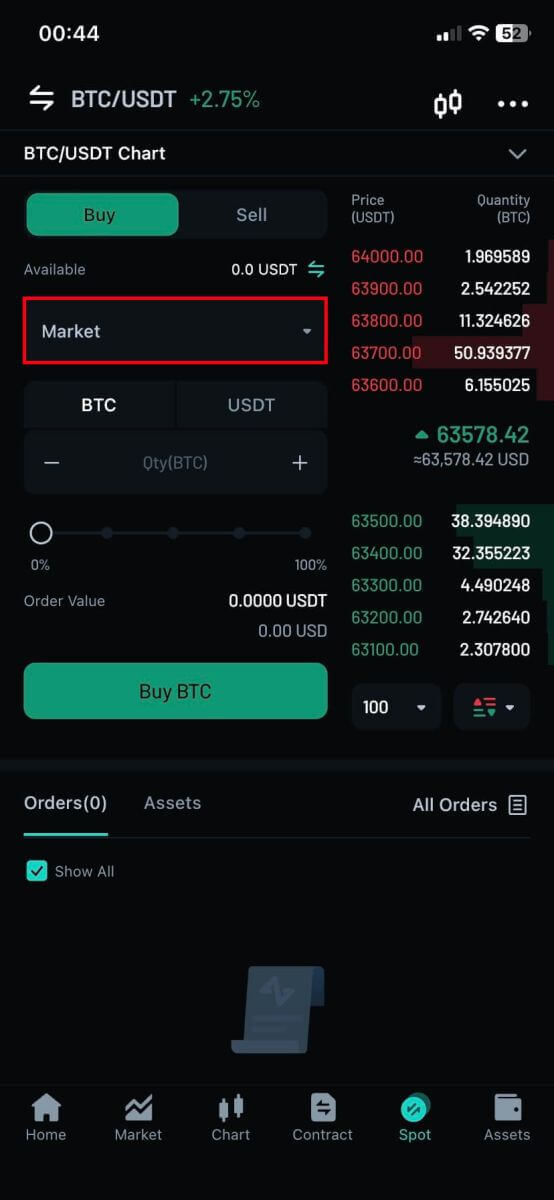

5. Zoomex has 3 Order Types:

- Limit Order:

Set your own buying or selling price. The trade will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for execution.

- Market Order:

This order type will automatically execute the trade at the current best price available in the market.

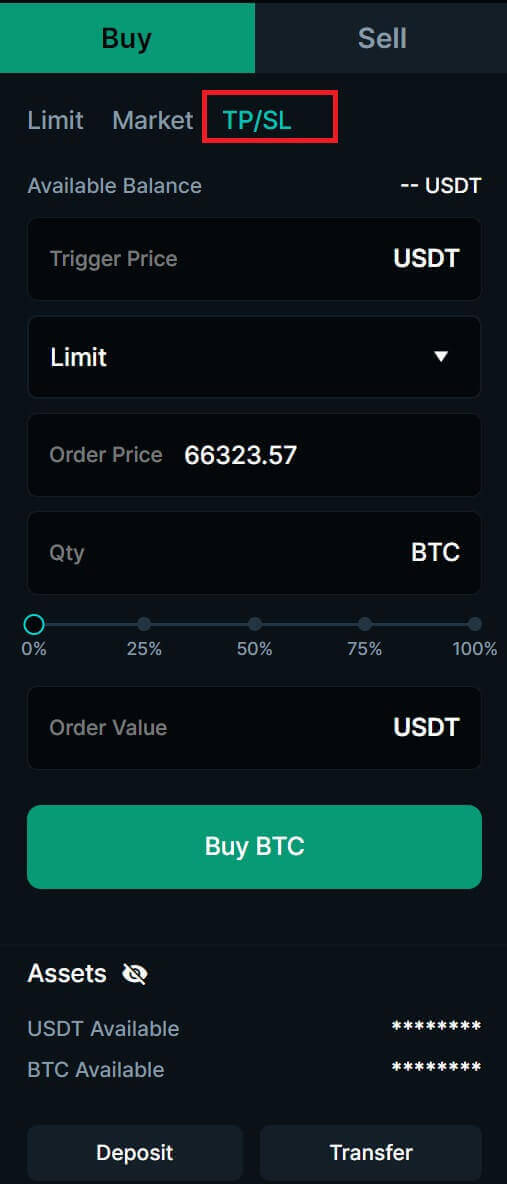

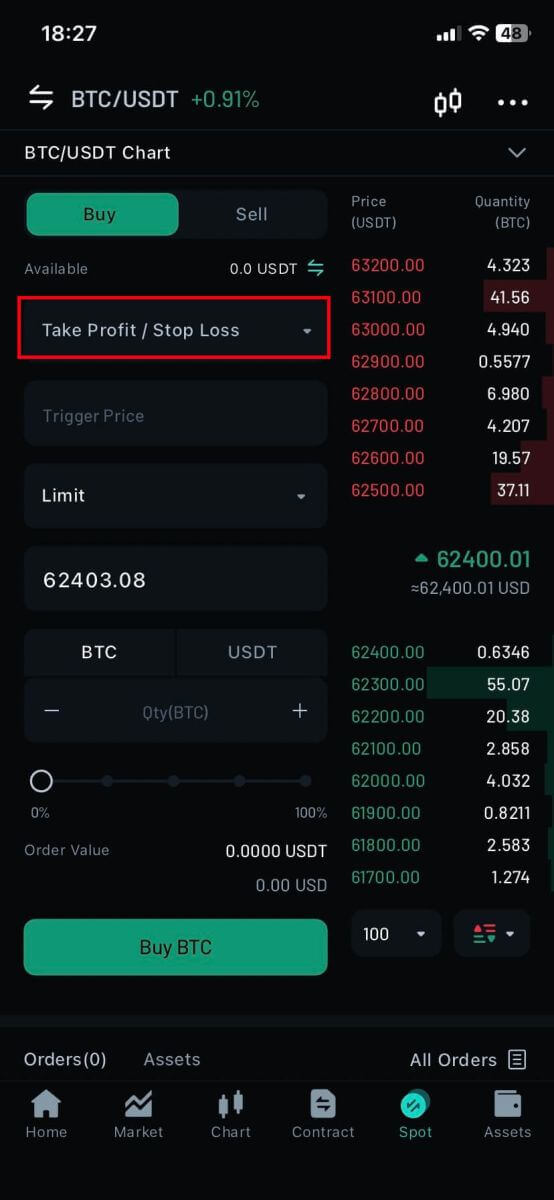

- TP/SL (Take profit - Stop limit)

You can set the trigger price, order price (for Limit orders), and order quantity for TP/SL orders. The assets will be reserved when the TP/SL order is placed. Once the last traded price reaches the preset trigger price, a Limit or Market order will be executed based on the specified order parameters.

- A Market order will be filled immediately at the best available market price.

- A Limit order will be submitted to the order book and will wait for execution at the specified order price. If the best bid/ask price is better than the order price, the Limit order may be executed immediately at the best bid/ask price. Therefore, traders should exercise caution with the non-guaranteed execution of Limit orders, as it depends on price movement and order book liquidity.

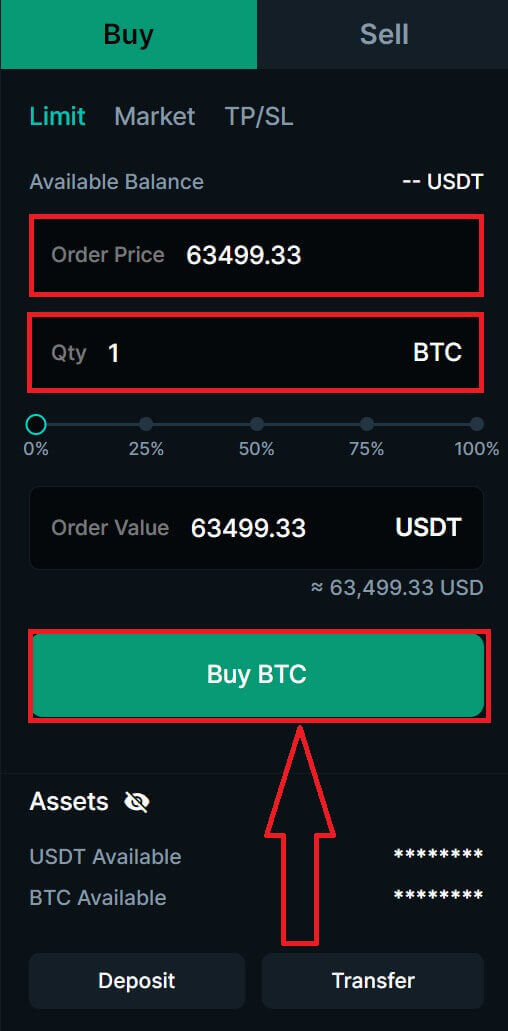

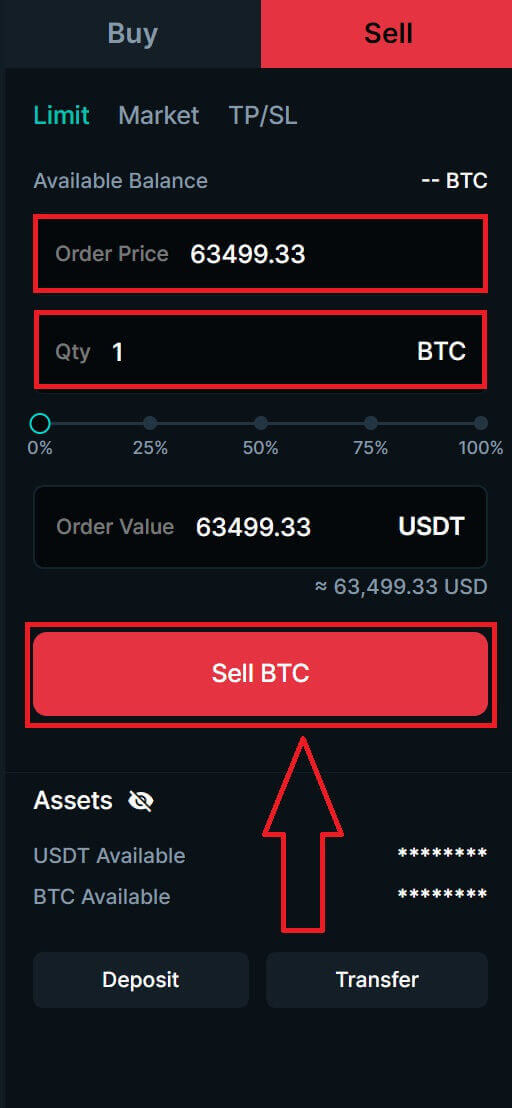

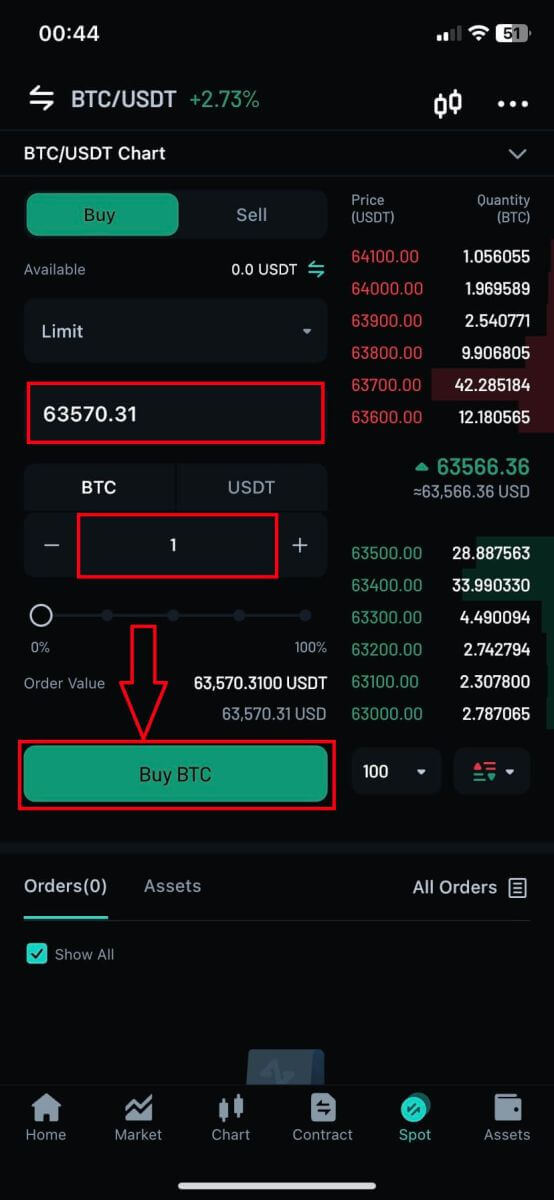

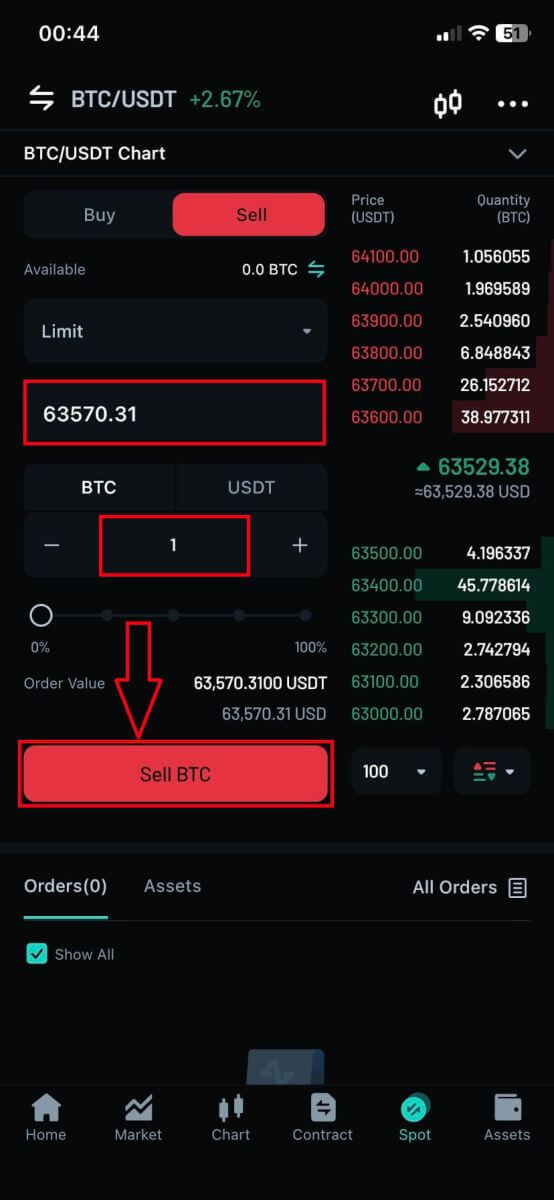

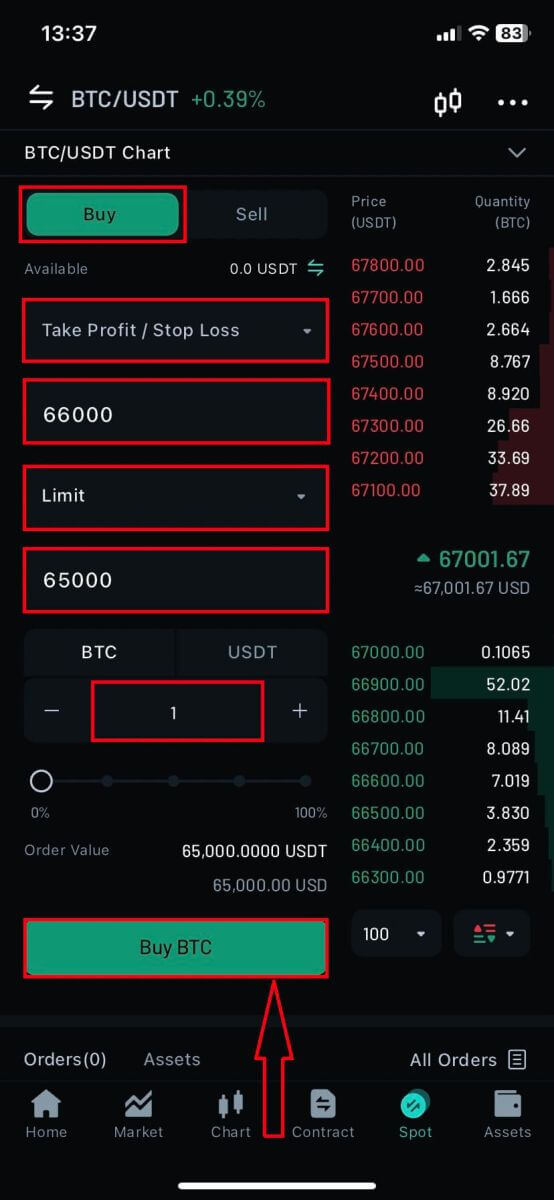

6. Choose the crypto you want to operate on the left crypto column. Then choose the trading type: [Buy] or [Sell] and the order type [Limit Order], [Market Order], [TP/SL].

- Limit Order:

- TP/SL Order:

Example: Assuming the current BTC price is 65,000 USDT, here are some scenarios for TP/SL orders with different triggers and order prices.

| TP/SL Market Sell Order Trigger Price: 64,000 USDT Order Price: N/A |

When the last traded price reaches the TP/SL trigger price of 64,000 USDT, the TP/SL order will be triggered, and a Market sell order will be placed immediately, selling the assets at the best available market price. |

| TP/SL Limit Buy Order Trigger Price: 66,000 USDT Order Price: 65,000 USDT |

When the last traded price reaches the TP/SL trigger price of 66,000 USDT, the TP/SL order will be triggered, and a Limit buy order with 65,000 USDT order price will be placed into the order book, awaiting execution. Once the last traded price reaches 65,000 USDT, the order will be executed. |

| TP/SL Limit Sell Order Trigger Price: 66,000 USDT Order Price: 66,000 USDT |

When the last traded price reaches the TP/SL trigger price of 66,000 USDT, the TP/SL order is triggered. Assuming the best bid price is 66,050 USDT after the trigger, the Limit sell order will be executed immediately at a price better (higher) than the order price, which is 66,050 USDT in this case. However, if the price drops below the order price upon triggering, a 66,000 USDT Limit sell order will be placed into the order book for execution. |

Frequently Asked Questions (FAQ)

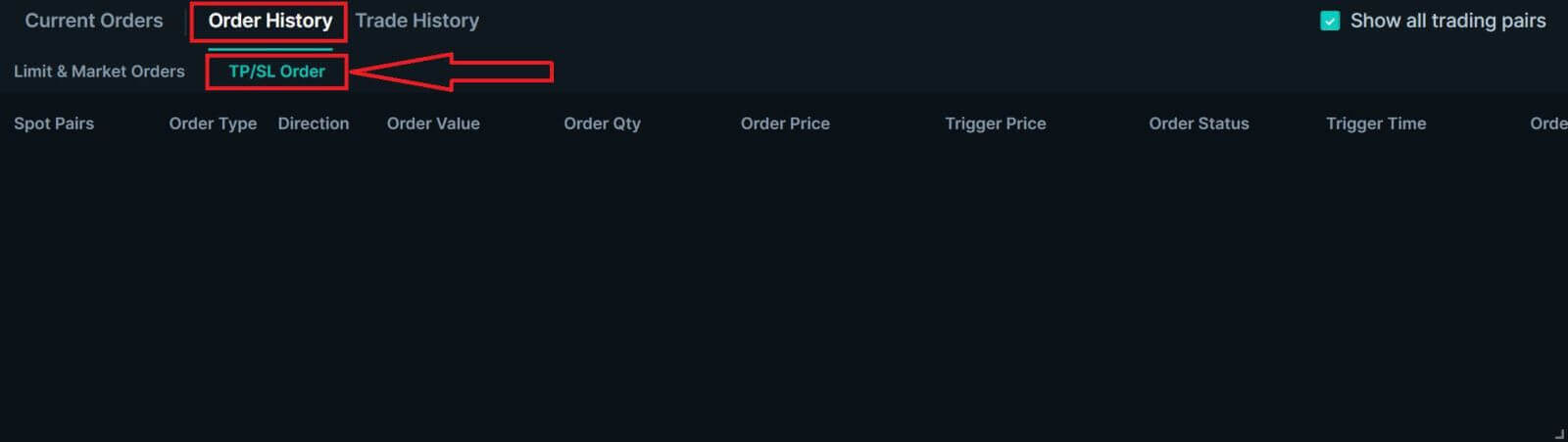

How to view my stop-limit orders?

Once you submit the orders, you can view and edit your stop-limit orders under [Orders History] in the [TP/SL Order].

Zoomex Spot Trading Fees

Below are the trading fees you’ll be charged when you trade Spot markets on Zoomex.

All Spot Trading Pairs:

Maker Fee Rate: 0.1%

Taker Fee Rate: 0.1%

Calculation Method for Spot Trading Fees:

Calculation formula: Trading Fee = Filled Order Quantity x Trading Fee Rate

Taking BTC/USDT as an example:

If the current price of BTC is $40,000. Traders can buy or sell 0.5 BTC with 20,000 USDT.

Trader A buys 0.5 BTC using a Market Order with USDT.

Trader B buys 20,000 USDT using a Limit Order with BTC.

Taker’s Fee for Trader A = 0.5 x 0.1% = 0.0005 BTC

Maker’s Fee for Trader B =20,000 x 0.1%= 20 USDT

After the order is filled:

Trader A buys 0.5 BTC with a Market Order, so he will pay a Taker’s Fee of 0.0005 BTC. Therefore, Trader A will receive 0.4995 BTC.

Trader B buys 20,000 USDT with a Limit Order, so he will pay a Maker’s Fee of 20 USDT. Therefore, Trader B will receive 19,980 USDT.

Notes:

- The trading fee unit charged is based on the purchased cryptocurrency.

- There is no trading fee for unfilled parts of orders and canceled orders.

Does Leverage Affects Your Unrealized PL?

The answer is no. On Zoomex, the main function of applying leverage is to determine the initial margin rate required to open your position, and selecting higher leverage does not directly amplify your profits. For example, Trader A opens a 20,000 Qty Buy Long inverse perpetual BTCUSD position on Zoomex. Refer to the table below to understand the relationship between leverage and initial margin.

| Leverage | Position Qty (1 Qty = 1 USD) | Initial Margin Rate (1/Leverage) | Initial Margin Amount (BTCUSD) |

| 1x | 20,000 USD | (1/1) = 100% | 20,000 USD worth in BTC |

| 2x | 20,000 USD | (1/2) = 50% | 10,000 USD worth in BTC |

| 5x | 20,000 USD | (1/5) = 20% | 4,000 USD worth in BTC |

| 10x | 20,000 USD | (1/10) = 10% | 2,000 USD worth in BTC |

| 50x | 20,000 USD | (1/50) = 2% | 400 USD worth in BTC |

| 100x | 20,000 USD | (1/100) = 1% | 200 USD worth in BTC |

Note:

1) Position Qty is the same regardless of leverage applied

2) Leverage determines the initial margin rate.

- The higher the leverage, the lower the initial margin rate and thus a lower initial margin amount.

3) Initial margin amount is calculated by taking position qty multiply by initial margin rate.

Next, Trader A is considering closing his 20,000 Qty Buy Long position at USD 60,000. Assuming that the average entry price of the position was recorded at USD 55,000. Refer to the table below shows the relationship between leverage, Unrealized PL (profit and loss) and Unrealized PL%

| Leverage | Position Qty (1 Qty = 1 USD) | Entry Price | Exit Price | Initial Margin Amount based on entry price of USD 55,000 (A) | Unrealized PL based on exit price of USD 60,000 (B) | Unrealized PL%(B) / (A) |

| 1x | 20,000 USD | 55,000 | 60,000 | 20,000/(55,000 x 1) = 0.36363636 BTC | 0.03030303 BTC | 8.33% |

| 2x | 20,000 USD | 55,000 | 60,000 | 20,000/(55,000 x 2) = 0.18181818 BTC | 0.03030303 BTC | 16.66% |

| 5x | 20,000 USD | 55,000 | 60,000 | 20,000/(55,000 x 5) = 0.07272727 BTC | 0.03030303 BTC | 41.66% |

| 10x | 20,000 USD | 55,000 | 60,000 | 20,000/(55,000 x 10) = 0.03636363 BTC | 0.03030303 BTC | 83.33% |

| 50x | 20,000 USD | 55,000 | 60,000 | 20,000/(55,000 x 50) = 0.00727272 BTC | 0.03030303 BTC | 416.66% |

| 100x | 20,000 USD | 55,000 | 60,000 | 20,000/(55,000 x 100) = 0.00363636 BTC | 0.03030303 BTC | 833.33% |

Note:

1) Notice that despite different leverages being applied for the same position qty, the resulting Unrealized PL based on exit price of USD 60,000 remains constant at 0.03030303 BTC.

- Therefore, higher leverage does not equal to higher PL.

2) Unrealized PL is calculated by taking into consideration the following variables: Position Qty, Entry Price and Exit Price

- The higher the Position Qty = the greater the PL

- The larger the price difference between entry price and exit price = the greater the Unrealized PL

3) Unrealized PL% is calculated by taking the Position Unrealized PL / Initial Margin Amount (B) / (A).

- The higher the leverage, the lower the initial margin amount (A), the higher the Unrealized PL%

- For more info, please refer to the articles below

4) The Unrealized PL and PL% illustration above does not take into consideration any trading fees or funding fees. For more info, please refer to the following articles

- Trading Fee Structure

- Funding fee calculation

- Why Did My Closed PL Record A Loss Despite The Position Showing a Green Unrealized Profit?

How to convert your assets?

To further enhance the trading experience and convenience for our customers, traders are now able to exchange their coins directly on zoomex for any of the other four cryptocurrencies available on the platform - BTC, ETH, EOS, XRP, USDT.

Notes:

1. No fees for asset exchanges. By exchanging your assets directly on zoomex, traders do not have to pay two-way transfer miner fee.

2. The transaction limit / 24 hours exchange limit for a single account is shown below:

| Coins | Per Transaction Minimum limit | Per Transaction Maximum limit | 24 hours user exchange limit | 24 hours platform exchange limit |

|---|---|---|---|---|

| BTC | 0.001 | 20 | 200 | 4000 |

| ETH | 0.01 | 250 | 2500 | 50,000 |

| EOS | 2 | 100,000 | 1,000,000 | 3,000,000 |

| XRP | 20 | 500,000 | 5,000,000 | 60,000,000 |

| USDT | 1 | 1,000,000 | 10,000,000 | 150,000,000 |

3. The bonus balance cannot be converted to other coins. It will not be forfeited upon submitting any coin conversion request as well.

4. The Real-Time Exchange Rate is based on the best quote price from several market makers according to the current index price.